Managing absence templates

In this guide:

- HR documents and templates

- Recruitment forms and templates

- Job offers, inductions and new starts templates

- Time off work policies and procedures

- Maternity, paternity, adoption, parental and shared parental leave letters and forms

- Managing absence templates

- Performance management and staff training templates

- Grievance and disciplinary procedures and templates

- Redundancy letters, forms and templates

- Other key HR policies and templates

Recruitment forms and templates

Sample recruitment templates including forms, letters, and documents to help you recruit, shortlist and interview potential employees.

Recruitment and selection of new employees should always be considered carefully by any business regardless of their size. The people you employ will form an essential part of your business strategy and will contribute greatly to the success of your business.

Staff recruitment templates

To ensure you attract the best people, you will need to ensure that your recruitment process is fine-tuned, non-discriminatory, and tailored to your business needs. For further guidance see the Employer's Handbook Section 2: Recruiting new employees (PDF, 420K).

For an overview of the recruitment stages and general considerations, download our recruitment process flowchart (DOC, 87K).

For sample template recruitment documents to help with particular stages of the recruitment process, see below.

Templates for advertising your job vacancy

You will need to prepare a job description, a personnel specification, and an application form to advertise your job vacancy. To help you do this, you can download and use our sample template recruitment documents and forms:

- sample job description template (DOC, 14K)

- sample personnel specification template (DOC, 15K)

- sample recruitment advertisement template (DOC, 16K)

- sample job application form template (DOC, 18K)

- sample monitoring questionnaire for job applicants template (DOC, 20K)

Templates for shortlisting candidates

Once you receive replies from candidates to your job vacancy advertisement, you will need to draw up a shortlist and invite those shortlisted to an interview. To help you do this, you can download and use our sample shortlisting documentation templates:

- sample shortlisting record table template (DOC, 15K)

- shortlisting guidance (DOC, 13K)

- sample letter of invitation to first interview template (DOC, 13K)

- sample rejection letter to applicant following shortlisting exercise template (DOC, 13K)

Templates for interviewing candidates

The more preparation you do for the job interview, the easier it will be for both you and the candidate. To help you prepare and carry out the interview process correctly, download and read our factsheets on interviewing, and use our sample record of interview templates:

- sample interview record document template (DOC, 14K)

- sample interview report document template (DOC, 14K)

- preparing for job interviews factsheet (DOC, 14K)

- interview practicalities and structure (DOC, 14K)

- do's and don'ts of interviewing job applicants (DOC, 15K)

- sample rejection letter to applicant following job interview template (DOC, 12K)

Read more on advertising a job and interviewing candidates.

Recruitment and selection tutorial videos

The embedded video below is an introduction to a tutorial on recruitment and selection. You can view the full Invest NI recruitment & selection tutorial.

ActionsAlso on this siteContent category

Source URL

/content/recruitment-forms-and-templates

Links

Job offers, inductions and new starts templates

Use our sample job offer letters, induction plans, and contract of employment to welcome and start a new member of your staff.

The final stage of the recruitment process involves choosing the successful candidate and making them a job offer.

You will need to consider whether you wish to make a job offer that is conditional on satisfactory references and right to work checks. If your job offer is accepted, you should arrange an induction plan for your new starter and consider the terms of your contract of employment.

Specific Employers' Handbook guidance

For further guidance on job offers, inductions and employment contracts see the following sections of the Invest Northern Ireland Employer's Handbook:

For sample documents to help you conclude your recruitment exercise fairly and efficiently, see relevant sections below.

Job offers

The initial job offer may be made by telephone. This should help you quickly establish if the individual wants to accept the job you are offering.

If that is the case, you should follow up with a formal letter of offer, and include details of any conditions attached to the job offer, eg satisfactory references. To help you do this, you can download and use our sample job offer letter and reference check form:

- sample letter of job offer to successful candidate (DOC, 12K)

- sample reference check form (DOC, 12K)

Contract of employment

The moment a candidate unconditionally accepts your offer of a job, a contract of employment comes into existence. To help you draft a contract of employment suitable to your business needs and the role in question, download and use our sample contract of employment, as well as staff policy documents to be included in it:

- sample contract of employment (DOC, 46K)

- sample sickness/absence notification and pay procedure (DOC, 27K)

Even if you do not issue a written contract of employment, you are under a legal duty to provide most employees with a written statement of main employment particulars within two months of the start of their employment with you.

Induction

You should aim to introduce, familiarise and integrate your new employee into your business as quickly as possible. Early induction will not only provide new-starters with the information they need to settle in, but will also provide them with the knowledge and skills that will help them contribute to your business right from the start.

To help you devise your staff induction activities, download and use our sample induction plans:

See induction programme: what to include.

View all recruitment & Selection - Invest NI tutorial videos.

ActionsAlso on this siteContent category

Source URL

/content/job-offers-inductions-and-new-starts-templates

Links

Time off work policies and procedures

Download a sample working time opt-out agreement and steps to help you determine your workers' leave entitlement.

You should set your normal working hours in your employment contract, or written statement of employment. Unless you operate within certain sectors, you cannot force your workers to work for more than 48 hours per week on average.

Special working time rules apply to young people. Find further information on hours, rest breaks and the working week.

If your workers wish to work for longer than 48 hours per week, they can choose to opt out of the Working Time Regulations. This must be done voluntarily and in writing in order for you to comply with the law.

Download our sample working time opt-out agreement (DOC, 14K).

Remember that you can't force your workers to sign an opt-out agreement or to cancel it, though a worker can cancel it voluntarily after giving you appropriate notice.

Annual leave

Most workers are legally entitled to paid holidays/annual leave.

A worker's statutory paid holiday entitlement in Northern Ireland is 5.6 weeks. This amounts to 28 days for a worker working a five-day week. This can include public and bank holidays. See:

- Know how much holiday to give your staff

- Calculate your employees' holiday entitlement

- Bank and public holiday dates

The leave entitlement for part-time workers or those who are about to leave employment is calculated on a pro-rata basis. Use the following step-by-step guidance to calculate how much leave these workers may be entitled to:

- download steps for determining leave entitlement of part-time workers (DOC, 13K)

- download steps for determining leave entitlement of leavers (DOC, 13K)

For additional leave information, such us notice periods, restrictions and holiday pay, see know how much holiday to give your staff.

For further guidance see Employers' Handbook Section 4: Working hours, rest breaks and time off (PDF, 83K).

Also on this siteContent category

Source URL

/content/time-work-policies-and-procedures

Links

Maternity, paternity, adoption, parental and shared parental leave letters and forms

Sample letters and application forms to help you manage your workers' rights to maternity, paternity, adoption, and shared parental leave.

Your responsibilities in relation to rights of working parents - or parents to be - are explained in our maternity, paternity, adoption and parental leave section.

Specific Employers' Handbook guidance

Further best practice advice and practical documents to help you communicate with your workers in respect of their entitlements are included in the Invest Northern Ireland Employers' Handbook including:

- Section 8: Maternity leave and pay (PDF, 83K)

- Section 9: Paternity leave and pay (PDF, 71K)

- Section 10: Adoption leave and pay (PDF, 71K)

- Section 11: Shared parental leave and pay (PDF, 114K)

- Section 12: Parental leave, parental bereavement leave and time off for dependants (PDF, 82K)

Sample employer documents

You can download, customise and use sample documents from the handbook that are relevant to maternity, paternity, adoption, parental and shared parental leave:

- model letter for employers to acknowledge notification of maternity leave (DOC, 14K)

- model letter for employers to acknowledge notification of adoption leave (DOC, 14K)

- sample employee application for parental leave (DOC, 14K)

- sample letter to employee of notification of postponement of parental leave (DOC, 13K)

- sample shared parental leave (birth) policy (DOC, 39K)

- sample shared parental leave (adoption) policy (DOC, 38K)

- sample confirmation of entitlement to shared parental leave (DOC, 27K)

- sample confirmation of shared parental leave booking (DOC, 27K)

- sample shared parental leave request to discuss leave booking (DOC, 27K)

- sample shared parental leave refusal of a discontinuous leave booking (DOC, 27K)

For help with administering paternity and adoption leave, use the maternity, paternity and adoption leave and pay calculator for employers.

ActionsAlso on this siteContent category

Source URL

/content/maternity-paternity-adoption-parental-and-shared-parental-leave-letters-and-forms

Links

Managing absence templates

Sample documents to help you manage staff absence with employment policies that follow good practice and comply with legislation.

Managing staff absence is a frequent and critical element to good people management within a business.

Absence causes difficulties both for the person who is absent and for the organisation. For small organisations in particular, where there are limited resources to cover and cope with the direct and indirect costs of an absence, it can be very disruptive.

Manage absence guidance

Further best practice advice and guidance to help your manage staff absence is included in the Invest Northern Ireland Employers' Handbook Section 19: Managing absence (PDF, 154K).

Manage absence templates

Sample templates are included in this section on managing staff absence that you can download and adapt specifically for your business purposes including:

- return to work interview format (DOC, 13K)

- example letter to employee seeking consent for a medical report from employee's GP (DOC, 14K)

- consent form for access to medical reports (DOC, 13K)

- summary of employee rights under the Access to Personal Files and Medical Reports (NI) Order 1991 (DOC, 15K)

- request to employee's GP for medical assessment (DOC, 15K)

- sample letter to an occupational health doctor requesting opinion on fitness for work (DOC, 14K)

Also on this siteContent category

Source URL

/content/managing-absence-templates

Links

Performance management and staff training templates

Sample letters and application forms to help you train and develop your staff, and monitor their performance.

Improving the skills of your staff can deliver real business benefits. It can increase their productivity, motivation and quality of work, and boost overall business profits and customer satisfaction. We have a number of free performance management and staff training templates that employers and HR professionals can use for their business.

Employers' Handbook: staff performance and training

Further best practice advice and practical documents to help you with staff performance, training and development are included in the Invest Northern Ireland Employers' Handbook including:

- Section 14: Managing employee performance (PDF, 229K)

- Section 15: Training and development (PDF, 69K)

Performance management templates

Agreeing appropriate objectives and making effective use of appraisals can improve your business performance and help you assess how well your employees are working.

If you're not sure where to start setting performance targets, download our sample agreement templates for different positions within the business:

- general performance agreement template (DOC, 13K)

- sample performance agreement - for operatives (DOC, 13K)

- sample performance agreement - for administrators (DOC, 15K)

- sample performance agreement - for managers (DOC, 14K)

Performance reviews templates

Download our two sample performance review form templates to help you assess employees' performance:

- sample performance review form (DOC, 18K)

- sample performance review form past and future performance (DOC, 16K)

Dealing with poor performance

Performance improvement measures can help you manage poor performance, and deal with your staff efficiently and fairly.

To see an overview of the measures required to deal with poor performance, download our formal performance improvement procedure flowchart (DOC, 20K).

Poor performance template letters

Use our downloadable sample letters to help you follow a fair and efficient performance improvement procedure when dealing with underperforming staff:

- sample letter of notice of performance improvement meeting (DOC, 13K)

- sample letter of recorded verbal warning due to poor performance (DOC, 14K)

- sample letter of first written warning due to poor performance (DOC, 14K)

- sample letter of final written warning due to poor performance (DOC, 14K)

- sample letter of dismissal or disciplinary action due to poor performance (DOC, 14K)

- sample letter of outcome of appeal following disciplinary action due to poor performance (DOC, 14K)

Training and development templates

Creating a training strategy usually involves assessing your training needs, determining the type of training best suited to your business and evaluating its effects to maximise the benefits.

To help get you started on the way to creating a successful training strategy, you can download and use the following training and development templates:

For further information, see training your staff and managing staff performance.

Training needs analysis tutorial videos

The embedded video below is an introduction to a tutorial on training needs analysis. You can view the full Invest NI training needs analysis tutorial.

ActionsAlso on this siteContent category

Source URL

/content/performance-management-and-staff-training-templates

Links

Grievance and disciplinary procedures and templates

Free templates to help employers and HR professionals handle any grievance, discipline, or dismissal situation fairly and in keeping with the law.

Even in well-run businesses, it may sometimes be necessary to deal with employee's grievances or disciplinary issues, or even dismissals. Having written rules and procedures for employee grievances or disciplinary issues may help you deal with them fairly and in keeping with employment law.

Specific Employers' Handbook guidance

Further best practice advice and practical templates to help you with staff grievances, disciplinary issues and dismissals are included in the Invest Northern Ireland Employers' Handbook including:

- Section 17: Employee grievances (PDF, 71K)

- Section 18: Disciplinary issues and dismissal (PDF, 143K)

For sample templates to help you deal with grievance, discipline, and dismissal situations, see the relevant sections below.

Grievance templates

Your grievance rules and procedures should be set out in writing and follow the good practice principles set out in the Labour Relations Agency (LRA) Code of Practice on Disciplinary and Grievance Procedures.

Download our sample letters and procedures templates to help you deal with grievances in your workplace:

- sample grievance procedure (DOC, 17K)

- sample letter of invitation to investigatory meeting - employee raising a grievance (DOC, 14K)

- sample letter of invitation to investigatory meeting - person against whom a grievance is raised (DOC, 14K)

Discipline and dismissal templates

Your disciplinary rules and procedures should be set out in writing and follow the good practice principles set out in the LRA Code of Practice on Disciplinary and Grievance Procedures.

Failure to meet this requirement may result in extra compensation for the employee if they succeed in a tribunal claim.

Download our sample notices and procedures templates to help you deal with disciplinary issues in your workplace:

- sample disciplinary rules and procedures for misconduct (DOC, 29K)

- sample notice of the disciplinary meeting (DOC, 14K)

- sample notice of the recorded disciplinary warning (DOC, 14K)

- sample notice of the appeal meeting against the disciplinary warning (DOC, 14K)

- sample notice of the result of the appeal against the disciplinary warning (DOC, 14K)

- sample notice of dismissal or disciplinary action to be taken (DOC, 12K)

- sample letter to be sent by the employer after the disciplinary meeting (DOC, 15K)

- sample notice of the appeal meeting against dismissal or disciplinary action (DOC, 14K)

- sample notice of the result of the appeal against the dismissal or disciplinary action (DOC, 14K)

- sample letter to be sent by the employer, setting out the reasons for the proposed dismissal or action other than dismissal and arranging the meeting (DOC, 15K)

For further information, see handling grievances, disciplinary procedures, hearings and appeals and dismissing employees.

ActionsAlso on this siteContent category

Source URL

/content/grievance-and-disciplinary-procedures-and-templates

Links

Redundancy letters, forms and templates

Forms and templates to help employers manage the redundancy process including redundancy letter templates.

A redundancy situation can arise in the following circumstances:

- the employer has ceased, or intends to cease, to carry on the business for the purposes of which the employee was so employed

- the employer has ceased, or intends to cease, to carry on the business in the place where the employee was so employed

- the requirements of the business for employees to carry out work of a particular kind has ceased or diminished or are expected to cease or diminish

- the requirements of the business for the employees to carry out work of a particular kind, in the place where they were so employed, has ceased or diminished or are expected to cease or diminish

Employers' Handbook redundancy guidance

Further best practice advice and practical documents to help you with redundancy are included in the Invest Northern Ireland Employers' Handbook including Section 22: Redundancy procedure (PDF, 199K)

Sample redundancy letters and documents

You can download the sample redundancy templates below to help you manage the redundancy process:

- redundancy ready reckoner table (DOC, 1MB)

- sample redundancy selection matrix template (DOC, 17K)

- sample redundancy letter for provisional selection for redundancy (DOC, 14K)

- sample redundancy letter for invitation to final consultation (DOC, 14K)

- sample redundancy letter for confirmation of redundancy (DOC, 16K)

- sample letter of offer of alternative role (DOC, 14K)

- sample letter for result of appeal (DOC, 14K)

- advance notification of redundancies form template (DOC, 21K)

For further information, see redundancy, restructures and change.

Alternatives to redundancy

You may wish to consider alternatives in order to avoid redundancies. For further guidance see Section 23: Lay-off and short-time working (PDF, 58K) of the Invest Northern Ireland Employers' Handbook.

Redundancy webinar

The Labour Relations Agency (LRA) redundancy webinar provides useful information on the topic of redundancy and how to ensure the redundancy process is managed fairly and in line with employment legislation.

ActionsAlso on this siteContent category

Source URL

/content/redundancy-letters-forms-and-templates

Links

Other key HR policies and templates

Sample documents to help you develop employment policies that follow good practices and comply with legislation.

You do not have to have a staff policy on every single aspect of your business. However, as an employer, you must legally set out details of your dismissal/disciplinary procedures in writing and, if you employ five or more people, you must have a written health and safety policy.

In instances where there may be no legal requirement, it is still good practice to set out formal written policies so that workers understand what is expected of them and what they can expect in return.

Other sample employer templates and documents

To help you develop up-to-date and compliant employer policies and procedures, you can download, customise and use our templates and sample documents:

- sample meeting action list (DOC, 13K)

- sample alcohol and drug policy (DOC, 17K)

- social media, internet and email policy and guidance checklist (DOC, 15K)

- sample social media, internet and email security policy guidelines (DOC, 24K)

Please note that this is not an exhaustive list of possible employment policies.

You should also consider developing policies on issues such as working time and time off, equality and diversity, bullying and harassment, training and performance management, and others.

To find more information on other relevant policies, see set up employment policies for your business.

Also on this siteContent category

Source URL

/content/other-key-hr-policies-and-templates

Links

Developing a staff training plan - Grants Electrical Services (video)

In this guide:

- Staff training

- Advantages of staff training

- How to identify staff training needs

- Develop a staff training plan

- Training methods to fit your business

- Find training courses in Northern Ireland

- Skill Up programme: Retrain and upskill your staff

- Gain training recognition

- Sector-specific skills and training in Northern Ireland

- Developing a staff training plan - Grants Electrical Services (video)

Advantages of staff training

Find out the many benefits staff training and skills development can bring to your workers and business.

Developing and implementing effective staff training can benefit your employees and your business. By investing in your staff, even on a small training budget, you can drive down costs to your business and help increase sales and profits.

What are the benefits of staff training?

Developing your workforce and improving their skills through training can:

- increase productivity

- enable skills development and spread the skills mix across your teams and organisation

- improve the quality of work

- establish a clear standard for trained members of staff

- give staff more responsibility and ownership of their job role

- reduce faults, waste, or customer complaints with streamlined processes and more competent staff

- positively affect staff morale and motivation - see lead and motivate your staff

- reduce staff turnover and absenteeism

- help your business adapt to change and prepare for growth - see change management and planning business growth

- give you a competitive advantage over your business rivals - see increase your market share

- offer development opportunities for your employees

- help you attract top talent if your business is seen as one that values and invests in their workers - see recruiting staff

Although staff training is often mandatory for new staff members, it is just as important to offer ongoing training opportunities for long-term employees. This helps staff realise that there is an opportunity within your organisation to develop, grow, and progress. Staff training develops the skills and capabilities that individuals need for their job and improves the overall efficiency and performance of a business as a whole.

Developed withActionsAlso on this siteContent category

Source URL

/content/advantages-staff-training

Links

How to identify staff training needs

How to identify a gap between employee knowledge and skills and training requirements using the training needs analysis technique.

To identify training that matches the specific needs of your staff and business goals, you can carry out a training needs analysis.

What is a training needs analysis?

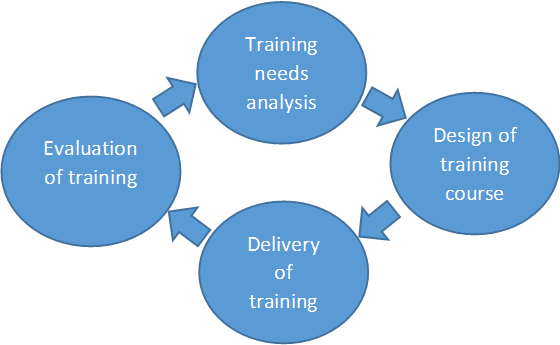

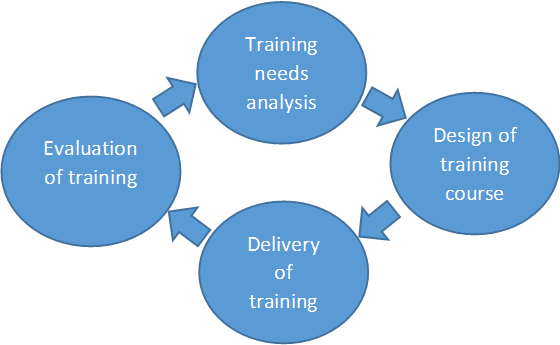

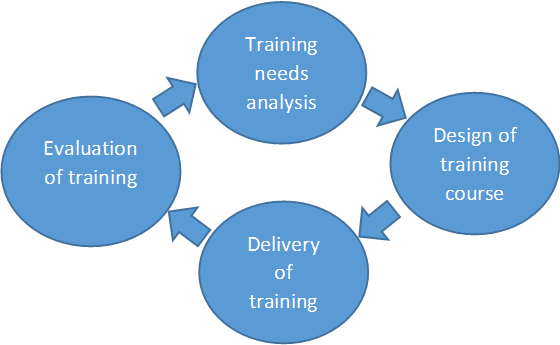

Training needs analysis is a method used by businesses to identify training requirements in a cost-efficient way. This process involves evaluating training needs and weighing up training priority areas at all levels within a business. Training needs analysis forms the first step of the training development cycle.

Training development cycle

What are the stages of training needs analysis?There are three key stages of training needs analysis. These steps involve identifying the direction of the organisation, understanding the skills and knowledge of staff through a task analysis, and analysing the individual needs of each employee. These three stages of training needs analysis are explained in more detail below:

Stage 1: Organisational needs

This step evaluates the overall training needs in the business. This is where you analyse future skills needs due to changes in products, equipment, technology, and teams, or in response to economic or political factors. Upcoming changes in law or industry standards may also influence the training needs of your business.

Practical ways of identifying organisational needs are by reviewing documents and processes, setting up advisory teams, and carrying out a SWOT (strengths, weaknesses, opportunities, and threats) analysis - see a SWOT analysis example.

Stage 2: Task analysis

At this level, you compare the job requirements of your business with existing employee skills and knowledge. This will help you identify the potential skills gaps. Here, you establish how often specific tasks are performed, the level of skill and knowledge required to perform these tasks, and where and how these skills are best acquired.

Practical ways of carrying out this analysis are to create assessment centres, tests, or practical observations of employees carrying out key tasks.

Stage 3: Individual needs

At this stage, you examine the training needs of each employee. This information is most often gathered from performance reviews and appraisal systems. You may seek feedback from employees on their recommendations on how to solve problems that may be hampering their day-to-day jobs.

Other practical ways of identifying individual training requirements for your employees are through surveys, questionnaires, interviews, and focus groups. Download our SWOT analysis template with specific staff training questions (DOC, 17K)

Support to help your business with training needs analysis

Invest Northern Ireland offers help and advice to local businesses on upskilling their workforce. The training needs analysis workshops give you an insight into the tools and techniques used by learning and development professionals to analyse training needs.

Training needs analysis tutorial videos

The embedded video below is an introduction to a tutorial on training needs analysis. You can view the full Invest NI training needs analysis tutorial.

Also on this siteContent category

Source URL

/content/how-identify-staff-training-needs

Links

Develop a staff training plan

How to put staff training into practice once you have identified priority areas for your employees and your business.

After you have identified the staff training required through training needs analysis, you will want to interpret the results and put your findings into practice.

Understanding the training needs analysis process

To effectively implement and deliver the benefits of your training needs analysis, you should consider the following steps:

1. Link skills requirements to your business goals and strategy

Embed the results of your training needs analysis within the direction of future training and skills development. This will ensure that you are applying your training budget effectively to the areas within your business that need it most.

2. Prioritise training needs

This is when you form the justification for your training budget by identifying how training will meet your business's key performance indicators (KPIs) - see use KPIs to assess business performance. Your initial analysis may have identified the need for staff training in multiple areas, so you will need to prioritise the parts that you will focus on first.

For example, you might consider whether the training can help employees carry out existing tasks more efficiently or to a higher standard, or if it will train staff to take on a new role with increased responsibilities. In short, you need to identify what is most important to your business.

To help identify priority training courses, you can carry out a training course priority weighting exercise. This is where you weigh up the costs and benefits of a number of training courses to identify the most beneficial one for your business. Download our training course priority weighting template (DOC, 13K).

3. Find training solutions

Establish how you will deliver the training, whether in-house or through external trainers. Some options include:

- conferences

- workshops/seminars

- e-learning/webinars

- books/journal

- coaching or mentoring

- job shadowing

- secondment

See a list of training methods to fit your business.

You can search our Events Finder for suitable training courses, workshops, webinars, and other business events.

4. Communicate

It is important to keep your employees informed of the reasons why they may have to complete certain training. Publish your training needs analysis findings and any associated training plans. Invite feedback from your employees on how they found the training they undertook.

5. Evaluate

You should evaluate the training outcomes by demonstrating how the training delivers value for money. Consider naming someone responsible for evaluating training (eg, a dedicated staff or line manager). Analyse the impact of all training on your employees, business, and productivity.

You can use a range of tools to give you qualitative and quantitative evaluation feedback. You should attempt to assess the impact of the training on employees by comparing their skills and abilities before and after training completion. The evidence you gather at this stage should be fed back to management as a demonstration of how the training provides a return on investment for the business.

Most training providers use evaluation methods that fit into the Kirkpatrick Model of Evaluation for Training (PDF, 302K), where example methods are matched to each level of evaluation.

Support to help your business with training needs analysis

Invest Northern Ireland offers help and advice to local businesses on upskilling their workforce. The training needs analysis workshops give you an insight into the tools and techniques used by learning and development professionals to analyse training needs.

Also on this siteContent category

Source URL

/content/develop-staff-training-plan

Links

Training methods to fit your business

A list of training methods that may be helpful to your business and boost the skills of your staff.

An outline of some methods your business could use to help train your staff, including their advantages and disadvantages.

Training method What it involves Advantages Disadvantages Coaching By talking through a problem or task with a coach/manager, employees can arrive at a solution or better method of working - Cost-effective if done in-house

- Specific to your business's needs

- Coach or manager needs to be coached initially

- Can be time-consuming

E-learning Employees follow courses online - Employees teach themselves at their convenience

- Low cost

- Courses tend to be general rather than specific to your business's needs

Evening classes Training through classes held in the evenings - No disruption to employees during working hours

- May disrupt the work-life balance for staff

- Employees may resent having to attend classes in the evening and may not turn up

Workshops A group of employees trains together under the supervision of a trainer - typically involves explanation, examples, trying out the skill or method, reviewing what happens, and considering developments and alternatives - Employees practice solving problems

- Time-consuming - typically takes at least half a day, if not more

- May be disruptive to your business if many employees attend at the same time

- Can be expensive if you send numerous employees to workshops

Study leave Employees are given paid leave to attend courses and attain a recognised qualification

- Both the business and employee benefit

- Can be a good recruitment incentive

- Tax relief may be available on the cost, of course,

- May be difficult to decide who is eligible

Induction Formal or informal way of helping a new employee to settle down quickly in the job by introducing them to people, the business, processes, etc - Great way to help a new employee get started and understand key organisational processes

- Can be formal or informal

- Low cost

- Focused on new employees and those starting new roles

- May take up a large part of a manager's time if many new people start at the same time

Job shadowing One employee observes another employee going about their job - Low cost

- Specific to your business/their role

- There isn't a chance for hands-on practical experience to be gained

- This may give a false perspective of the job role depending on the person being shadowed and when the job shadowing is taking place.

Mentoring A more senior person typically supports an executive or manager, or director by providing advice, support, and a forum for discussing problems - Provides personal development

- Low-cost

- Limited to more senior employees

- For mentoring to be effective, the personalities and experiences of the mentor and employee need to be complementary

Networking / seminars

Employees attend a seminar on a specific topic - this can be in-house, at an industry event, or organised by a training specialist - Useful way of getting a lot of information over to a large audience

- At industry events and seminars organised by training specialists, employees can talk to their peers as competitors/partners

- Employees may be unable to discuss specific problems in front of rivals

- Retention of information may be low if there is a lot of information to convey to employees

Distance learning Employees train through courses devised by educational institutions (eg, Open University) but are not required to attend traditional classes - Increasingly web-based

- Employees can learn at their convenience

- Courses tend to be general rather than specific to your business's needs

Simulation / role-playing Typically, employees in a particular department (eg, sales) come together to take on roles to help work through possible scenarios (eg, customer complaint)

- Employees learn by doing and are prepared for possible situations at work

- Specific to your business

- Can be led by a manager

- Artificial situations remove the stress and complexities that may occur in a real-life situation

- There is always room for error when creating a situation in a training environment

Also on this siteContent category

Source URL

/content/training-methods-fit-your-business

Links

Find training courses in Northern Ireland

What to consider when choosing a suitable training provider, and where you can find training courses in Northern Ireland.

There are many organisations offering training courses throughout Northern Ireland. There are also free online training resources to help you and your staff develop their skills and make your business more competitive.

Free short-term courses (Skill Up programme)

The Department for the Economy is supporting free places on a range of fully accredited courses to help individuals retrain and improve their skills. The courses will be delivered by local universities and Further Education colleges through the Skill Up programme. See Skill Up programme: Retrain and upskill your staff.

Open University courses

The Open University has partnered with Invest Northern Ireland to provide local businesses with online training and learning resources to support upskilling in industry.

The Open University has also partnered with the Department for the Economy to offer a range of free training to help you improve your skills and wellbeing.

The Open University offers a wide range of online courses.

Other online courses

AbilityNet helps people of any age and with any disability to use technology to achieve their goals at home, at work, and in education.

Alison is a free learning platform for education and skills training. It is a not-for-profit social enterprise dedicated to making it possible for anyone, to study anything, anywhere, at any time, for free online, at any subject level.

AWS Training & Certification is free to register and offers over 500 free courses to build AWS Cloud Skills.

BBC Skillswise offers a collection of free videos and downloadable worksheets to help adult learners improve their reading, writing and numeracy skills.

BT Skills for Tomorrow offers a range of free resources anyone can use to help them stay safe, connected, and informed online.

Carnegie Trust in partnership with CILIP Library Association offers online development materials on leadership and innovation, including transformation, creativity, and innovation, influencing skills and power.

Class Central offers several thousand free online courses that have been developed by a number of top universities from across the globe, including in ICT and business.

Class of 2020 offers learning and development materials on upskilling programmes for graduates, including short courses, live webinars, business challenges, and questions and answers.

Coursera brings together courses and certificates provided online for free by a variety of universities and companies. The main focus is on science, technology, engineering, and mathematics, with additional material in other areas also available.

CoursesOnline provides a huge range of training courses from the UK's leading educational providers. There are many courses to choose from, including business, IT, accountancy, human resources, marketing, and many more.

Google Digital Garage offers over 40 hours worth of training to get the digital skills you need to start your career or grow your business.

Invest NI offers a wide range of tools and business tutorials to support improvements in business processes and growth. The training needs analysis workshops also give you an insight into the tools and techniques used by learning and development professionals to analyse training needs.

Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that let learners study at their own pace in and outside of the classroom, offering mathematics, science, computer programming, history, art history, economics, and more.

Learn My Way is a website of free online courses, built by Good Things Foundation to help people develop their digital skills.

Oxford Home Study College offers a range of fully certified provision, including cybersecurity, digital marketing, life coaching, and planning.

Training Matchmaker offers a range of free short courses, based online or across Northern Ireland, in a wide range of technical and vocational areas.

Business Events Finder

You can also search our Events Finder for business-related training, workshops, conferences, and webinars from a variety of organisations.

Choosing a training provider: what to consider

When deciding who to select for your training provider, you should consider:

- Does the trainer understand your business? Is their experience relevant to your sector?

- Is the training at the right level, is it tailored to your business, as opposed to being a generic course?

- Do the logistics of the training satisfy you? Is it hosted online or held at an appropriate venue, at the right times and dates that suit your schedule?

- Is the trainer or training business linked to any associations that can recommend them?

- Could you speak to other clients who have undergone the training?

It is likely that there will be a number of suppliers offering possible courses. You should investigate each one thoroughly to ensure they meet your requirements before going ahead.

Developed withAlso on this siteContent category

Source URL

/content/find-training-courses-northern-ireland

Links

Skill Up programme: Retrain and upskill your staff

Find free training opportunities to help develop the skills of your staff through the fully funded Skill Up programme.

Skill Up offers opportunities for businesses to retrain and upskill their staff by taking advantage of a range of free accredited courses. The training will be delivered by the local further and higher education providers in Northern Ireland.

Opportunities are available from entry to postgraduate levels, focusing on skills identified by industry, linked to priority economic areas, including:

- green skills

- software

- advanced manufacturing

- childcare

- health and social care

- hospitality

- transversal skills

Training courses available for 2024-25

If you are interested in the training courses available from local colleges and universities for the 2024-25 academic year, visit the provider’s website.

Queen’s University Belfast

Further information and details on how to apply for Queen's University Skill Up courses.

Ulster University

Further information and details on how to apply to the Ulster University Skill Up courses.

St Mary's University College

Further information and details on how to apply to the St Mary's University College course.

Stranmillis University College

Further information and details on how to apply to the Stranmillis University College courses.

North West Regional College

Further information and details on how to apply to the North West Regional College's Skill Up courses.

Belfast Metropolitan College

Further information and details on how to apply to the Belfast Met Skill Up courses.

Northern Regional College

Further information and details on how to apply to the Northern Regional College's Skill Up courses.

Southern Regional College

Further information and details on how to apply to the Southern Regional College's Skill Up courses.

South Eastern Regional College

Further information and details on how to apply to the South Eastern Regional College's Skill Up courses.

South West College

Further information and details on how to apply to the South West College's Skill Up courses.

The Open University

Applications for Open University Skill Up courses closed at midday on Thursday 12 September 2024.

Find further information on the Open University Skill Up courses.

Full list of Skill Up courses

For a breakdown of Skill Up courses available across the organisations, see Skill Up.

Developed withAlso on this siteContent category

Source URL

/content/skill-programme-retrain-and-upskill-your-staff

Links

Gain training recognition

How to get recognition and reward for your training efforts through Investors in People and various business awards.

Being recognised as an organisation that invests in its people through training and development can impress prospective customers, suppliers, and new recruits.

Investors in People

If you are seeking recognition for your training efforts and effective engagement with staff, you should consider applying for the Investors in People Awards. Investors in People is a management standard for high performance through people. The prestigious accreditation is recognised across the world as a mark of excellence.

Read more on Investors in People: the Standard for people management.

Recognition through business awards

Business awards run by various organisations and local councils usually have award categories that recognise the efforts of employers to train, develop, and look after their staff. You may find it beneficial to apply for business awards in order to have your training efforts recognised and rewarded.

Find business awards

You can find business awards by checking our business news section or business support finder.

Developed withAlso on this siteContent category

Source URL

/content/gain-training-recognition

Links

Sector-specific skills and training in Northern Ireland

Where to find staff training and skills development specifically tailored to your business sector.

There are several sources of sector-specific advice on skills development for employees working in a particular industry. Employers can also get involved in helping to influence how training is adapted to match the needs of their industries.

Sectoral partnerships

The purpose of sectoral partnerships is to review and develop the content of all youth traineeship and apprenticeship frameworks from level 2 to level 8 to ensure that all those involved in training are industry-ready.

There are 15 sectoral partnerships that have been established so far, including:

- Advanced Manufacturing and Engineering

- Agri-Food Manufacturing

- Built Environment

- Finance and Accounting

- Hair and Beauty

- Health and Social Care

- Hospitality and Tourism

- ICT

- Life and Health Services

- Sales and Marketing

- Business and Administration

- Childcare and Youth Work

- Civil Engineering

- Creative and Cultural

- Motor Vehicle

Employers are encouraged to become involved in sectoral partnerships to ensure apprentices and trainees are getting high-quality training that provides them with the right skills for a career in their chosen industry.

Read more on sectoral partnerships.

Sector Training Councils (STCs)

Sector Training Councils are independent employer representative bodies in Northern Ireland. Their role is to:

- articulate the skills, education, and training needs of their sectors in the short and long term

- advise on training standards required for their sectors

- work with the Department for the Economy (DfE), employers, and industry trade bodies to ensure that training needs and standards are met

You can find out more about individual Sector Training Councils at the links below:

Developed withAlso on this siteContent category

Source URL

/content/sector-specific-skills-and-training-northern-ireland

Links

Staff training

Developing a staff training plan - Grants Electrical Services (video)

Grants Electrical Services, based in Mallusk, explains how they identify staff training needs and put training plans in place to develop staff skills.

Grants Electrical Services Ltd (GES), based in Mallusk, is an electrical and mechanical engineering company. They sell industrial engineering applications to customers throughout the UK and Europe. GES employs approximately 90 staff who specialise in various aspects of niche engineering.

Rachel Doherty explains the approach that GES took to identify staff training needs and develop employee skills. She describes how, following a formal analysis process, they went on to fill gaps in both staff knowledge and skills. This has helped to contribute to the company's growth. Rachel also highlights how GES has developed bespoke in-house leadership and management training that has won industry awards.

Case StudyRachel DohertyContent category

Source URL

/content/developing-staff-training-plan-grants-electrical-services-video

Links

Develop a staff training plan

In this guide:

- Staff training

- Advantages of staff training

- How to identify staff training needs

- Develop a staff training plan

- Training methods to fit your business

- Find training courses in Northern Ireland

- Skill Up programme: Retrain and upskill your staff

- Gain training recognition

- Sector-specific skills and training in Northern Ireland

- Developing a staff training plan - Grants Electrical Services (video)

Advantages of staff training

Find out the many benefits staff training and skills development can bring to your workers and business.

Developing and implementing effective staff training can benefit your employees and your business. By investing in your staff, even on a small training budget, you can drive down costs to your business and help increase sales and profits.

What are the benefits of staff training?

Developing your workforce and improving their skills through training can:

- increase productivity

- enable skills development and spread the skills mix across your teams and organisation

- improve the quality of work

- establish a clear standard for trained members of staff

- give staff more responsibility and ownership of their job role

- reduce faults, waste, or customer complaints with streamlined processes and more competent staff

- positively affect staff morale and motivation - see lead and motivate your staff

- reduce staff turnover and absenteeism

- help your business adapt to change and prepare for growth - see change management and planning business growth

- give you a competitive advantage over your business rivals - see increase your market share

- offer development opportunities for your employees

- help you attract top talent if your business is seen as one that values and invests in their workers - see recruiting staff

Although staff training is often mandatory for new staff members, it is just as important to offer ongoing training opportunities for long-term employees. This helps staff realise that there is an opportunity within your organisation to develop, grow, and progress. Staff training develops the skills and capabilities that individuals need for their job and improves the overall efficiency and performance of a business as a whole.

Developed withActionsAlso on this siteContent category

Source URL

/content/advantages-staff-training

Links

How to identify staff training needs

How to identify a gap between employee knowledge and skills and training requirements using the training needs analysis technique.

To identify training that matches the specific needs of your staff and business goals, you can carry out a training needs analysis.

What is a training needs analysis?

Training needs analysis is a method used by businesses to identify training requirements in a cost-efficient way. This process involves evaluating training needs and weighing up training priority areas at all levels within a business. Training needs analysis forms the first step of the training development cycle.

Training development cycle

What are the stages of training needs analysis?There are three key stages of training needs analysis. These steps involve identifying the direction of the organisation, understanding the skills and knowledge of staff through a task analysis, and analysing the individual needs of each employee. These three stages of training needs analysis are explained in more detail below:

Stage 1: Organisational needs

This step evaluates the overall training needs in the business. This is where you analyse future skills needs due to changes in products, equipment, technology, and teams, or in response to economic or political factors. Upcoming changes in law or industry standards may also influence the training needs of your business.

Practical ways of identifying organisational needs are by reviewing documents and processes, setting up advisory teams, and carrying out a SWOT (strengths, weaknesses, opportunities, and threats) analysis - see a SWOT analysis example.

Stage 2: Task analysis

At this level, you compare the job requirements of your business with existing employee skills and knowledge. This will help you identify the potential skills gaps. Here, you establish how often specific tasks are performed, the level of skill and knowledge required to perform these tasks, and where and how these skills are best acquired.

Practical ways of carrying out this analysis are to create assessment centres, tests, or practical observations of employees carrying out key tasks.

Stage 3: Individual needs

At this stage, you examine the training needs of each employee. This information is most often gathered from performance reviews and appraisal systems. You may seek feedback from employees on their recommendations on how to solve problems that may be hampering their day-to-day jobs.

Other practical ways of identifying individual training requirements for your employees are through surveys, questionnaires, interviews, and focus groups. Download our SWOT analysis template with specific staff training questions (DOC, 17K)

Support to help your business with training needs analysis

Invest Northern Ireland offers help and advice to local businesses on upskilling their workforce. The training needs analysis workshops give you an insight into the tools and techniques used by learning and development professionals to analyse training needs.

Training needs analysis tutorial videos

The embedded video below is an introduction to a tutorial on training needs analysis. You can view the full Invest NI training needs analysis tutorial.

Also on this siteContent category

Source URL

/content/how-identify-staff-training-needs

Links

Develop a staff training plan

How to put staff training into practice once you have identified priority areas for your employees and your business.

After you have identified the staff training required through training needs analysis, you will want to interpret the results and put your findings into practice.

Understanding the training needs analysis process

To effectively implement and deliver the benefits of your training needs analysis, you should consider the following steps:

1. Link skills requirements to your business goals and strategy

Embed the results of your training needs analysis within the direction of future training and skills development. This will ensure that you are applying your training budget effectively to the areas within your business that need it most.

2. Prioritise training needs

This is when you form the justification for your training budget by identifying how training will meet your business's key performance indicators (KPIs) - see use KPIs to assess business performance. Your initial analysis may have identified the need for staff training in multiple areas, so you will need to prioritise the parts that you will focus on first.

For example, you might consider whether the training can help employees carry out existing tasks more efficiently or to a higher standard, or if it will train staff to take on a new role with increased responsibilities. In short, you need to identify what is most important to your business.

To help identify priority training courses, you can carry out a training course priority weighting exercise. This is where you weigh up the costs and benefits of a number of training courses to identify the most beneficial one for your business. Download our training course priority weighting template (DOC, 13K).

3. Find training solutions

Establish how you will deliver the training, whether in-house or through external trainers. Some options include:

- conferences

- workshops/seminars

- e-learning/webinars

- books/journal

- coaching or mentoring

- job shadowing

- secondment

See a list of training methods to fit your business.

You can search our Events Finder for suitable training courses, workshops, webinars, and other business events.

4. Communicate

It is important to keep your employees informed of the reasons why they may have to complete certain training. Publish your training needs analysis findings and any associated training plans. Invite feedback from your employees on how they found the training they undertook.

5. Evaluate

You should evaluate the training outcomes by demonstrating how the training delivers value for money. Consider naming someone responsible for evaluating training (eg, a dedicated staff or line manager). Analyse the impact of all training on your employees, business, and productivity.

You can use a range of tools to give you qualitative and quantitative evaluation feedback. You should attempt to assess the impact of the training on employees by comparing their skills and abilities before and after training completion. The evidence you gather at this stage should be fed back to management as a demonstration of how the training provides a return on investment for the business.

Most training providers use evaluation methods that fit into the Kirkpatrick Model of Evaluation for Training (PDF, 302K), where example methods are matched to each level of evaluation.

Support to help your business with training needs analysis

Invest Northern Ireland offers help and advice to local businesses on upskilling their workforce. The training needs analysis workshops give you an insight into the tools and techniques used by learning and development professionals to analyse training needs.

Also on this siteContent category

Source URL

/content/develop-staff-training-plan

Links

Training methods to fit your business

A list of training methods that may be helpful to your business and boost the skills of your staff.

An outline of some methods your business could use to help train your staff, including their advantages and disadvantages.

Training method What it involves Advantages Disadvantages Coaching By talking through a problem or task with a coach/manager, employees can arrive at a solution or better method of working - Cost-effective if done in-house

- Specific to your business's needs

- Coach or manager needs to be coached initially

- Can be time-consuming

E-learning Employees follow courses online - Employees teach themselves at their convenience

- Low cost

- Courses tend to be general rather than specific to your business's needs

Evening classes Training through classes held in the evenings - No disruption to employees during working hours

- May disrupt the work-life balance for staff

- Employees may resent having to attend classes in the evening and may not turn up

Workshops A group of employees trains together under the supervision of a trainer - typically involves explanation, examples, trying out the skill or method, reviewing what happens, and considering developments and alternatives - Employees practice solving problems

- Time-consuming - typically takes at least half a day, if not more

- May be disruptive to your business if many employees attend at the same time

- Can be expensive if you send numerous employees to workshops

Study leave Employees are given paid leave to attend courses and attain a recognised qualification

- Both the business and employee benefit

- Can be a good recruitment incentive

- Tax relief may be available on the cost, of course,

- May be difficult to decide who is eligible

Induction Formal or informal way of helping a new employee to settle down quickly in the job by introducing them to people, the business, processes, etc - Great way to help a new employee get started and understand key organisational processes

- Can be formal or informal

- Low cost

- Focused on new employees and those starting new roles

- May take up a large part of a manager's time if many new people start at the same time

Job shadowing One employee observes another employee going about their job - Low cost

- Specific to your business/their role

- There isn't a chance for hands-on practical experience to be gained

- This may give a false perspective of the job role depending on the person being shadowed and when the job shadowing is taking place.

Mentoring A more senior person typically supports an executive or manager, or director by providing advice, support, and a forum for discussing problems - Provides personal development

- Low-cost

- Limited to more senior employees

- For mentoring to be effective, the personalities and experiences of the mentor and employee need to be complementary

Networking / seminars

Employees attend a seminar on a specific topic - this can be in-house, at an industry event, or organised by a training specialist - Useful way of getting a lot of information over to a large audience

- At industry events and seminars organised by training specialists, employees can talk to their peers as competitors/partners

- Employees may be unable to discuss specific problems in front of rivals

- Retention of information may be low if there is a lot of information to convey to employees

Distance learning Employees train through courses devised by educational institutions (eg, Open University) but are not required to attend traditional classes - Increasingly web-based

- Employees can learn at their convenience

- Courses tend to be general rather than specific to your business's needs

Simulation / role-playing Typically, employees in a particular department (eg, sales) come together to take on roles to help work through possible scenarios (eg, customer complaint)

- Employees learn by doing and are prepared for possible situations at work

- Specific to your business

- Can be led by a manager

- Artificial situations remove the stress and complexities that may occur in a real-life situation

- There is always room for error when creating a situation in a training environment

Also on this siteContent category

Source URL

/content/training-methods-fit-your-business

Links

Find training courses in Northern Ireland

What to consider when choosing a suitable training provider, and where you can find training courses in Northern Ireland.

There are many organisations offering training courses throughout Northern Ireland. There are also free online training resources to help you and your staff develop their skills and make your business more competitive.

Free short-term courses (Skill Up programme)

The Department for the Economy is supporting free places on a range of fully accredited courses to help individuals retrain and improve their skills. The courses will be delivered by local universities and Further Education colleges through the Skill Up programme. See Skill Up programme: Retrain and upskill your staff.

Open University courses

The Open University has partnered with Invest Northern Ireland to provide local businesses with online training and learning resources to support upskilling in industry.

The Open University has also partnered with the Department for the Economy to offer a range of free training to help you improve your skills and wellbeing.

The Open University offers a wide range of online courses.

Other online courses

AbilityNet helps people of any age and with any disability to use technology to achieve their goals at home, at work, and in education.

Alison is a free learning platform for education and skills training. It is a not-for-profit social enterprise dedicated to making it possible for anyone, to study anything, anywhere, at any time, for free online, at any subject level.

AWS Training & Certification is free to register and offers over 500 free courses to build AWS Cloud Skills.

BBC Skillswise offers a collection of free videos and downloadable worksheets to help adult learners improve their reading, writing and numeracy skills.

BT Skills for Tomorrow offers a range of free resources anyone can use to help them stay safe, connected, and informed online.

Carnegie Trust in partnership with CILIP Library Association offers online development materials on leadership and innovation, including transformation, creativity, and innovation, influencing skills and power.

Class Central offers several thousand free online courses that have been developed by a number of top universities from across the globe, including in ICT and business.

Class of 2020 offers learning and development materials on upskilling programmes for graduates, including short courses, live webinars, business challenges, and questions and answers.

Coursera brings together courses and certificates provided online for free by a variety of universities and companies. The main focus is on science, technology, engineering, and mathematics, with additional material in other areas also available.

CoursesOnline provides a huge range of training courses from the UK's leading educational providers. There are many courses to choose from, including business, IT, accountancy, human resources, marketing, and many more.

Google Digital Garage offers over 40 hours worth of training to get the digital skills you need to start your career or grow your business.

Invest NI offers a wide range of tools and business tutorials to support improvements in business processes and growth. The training needs analysis workshops also give you an insight into the tools and techniques used by learning and development professionals to analyse training needs.

Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that let learners study at their own pace in and outside of the classroom, offering mathematics, science, computer programming, history, art history, economics, and more.

Learn My Way is a website of free online courses, built by Good Things Foundation to help people develop their digital skills.

Oxford Home Study College offers a range of fully certified provision, including cybersecurity, digital marketing, life coaching, and planning.

Training Matchmaker offers a range of free short courses, based online or across Northern Ireland, in a wide range of technical and vocational areas.

Business Events Finder

You can also search our Events Finder for business-related training, workshops, conferences, and webinars from a variety of organisations.

Choosing a training provider: what to consider

When deciding who to select for your training provider, you should consider:

- Does the trainer understand your business? Is their experience relevant to your sector?

- Is the training at the right level, is it tailored to your business, as opposed to being a generic course?

- Do the logistics of the training satisfy you? Is it hosted online or held at an appropriate venue, at the right times and dates that suit your schedule?

- Is the trainer or training business linked to any associations that can recommend them?

- Could you speak to other clients who have undergone the training?

It is likely that there will be a number of suppliers offering possible courses. You should investigate each one thoroughly to ensure they meet your requirements before going ahead.

Developed withAlso on this siteContent category

Source URL

/content/find-training-courses-northern-ireland

Links

Skill Up programme: Retrain and upskill your staff

Find free training opportunities to help develop the skills of your staff through the fully funded Skill Up programme.

Skill Up offers opportunities for businesses to retrain and upskill their staff by taking advantage of a range of free accredited courses. The training will be delivered by the local further and higher education providers in Northern Ireland.

Opportunities are available from entry to postgraduate levels, focusing on skills identified by industry, linked to priority economic areas, including:

- green skills

- software

- advanced manufacturing

- childcare

- health and social care

- hospitality

- transversal skills

Training courses available for 2024-25

If you are interested in the training courses available from local colleges and universities for the 2024-25 academic year, visit the provider’s website.

Queen’s University Belfast

Further information and details on how to apply for Queen's University Skill Up courses.

Ulster University

Further information and details on how to apply to the Ulster University Skill Up courses.

St Mary's University College

Further information and details on how to apply to the St Mary's University College course.

Stranmillis University College

Further information and details on how to apply to the Stranmillis University College courses.

North West Regional College

Further information and details on how to apply to the North West Regional College's Skill Up courses.

Belfast Metropolitan College

Further information and details on how to apply to the Belfast Met Skill Up courses.

Northern Regional College

Further information and details on how to apply to the Northern Regional College's Skill Up courses.

Southern Regional College

Further information and details on how to apply to the Southern Regional College's Skill Up courses.

South Eastern Regional College

Further information and details on how to apply to the South Eastern Regional College's Skill Up courses.

South West College

Further information and details on how to apply to the South West College's Skill Up courses.

The Open University

Applications for Open University Skill Up courses closed at midday on Thursday 12 September 2024.

Find further information on the Open University Skill Up courses.

Full list of Skill Up courses

For a breakdown of Skill Up courses available across the organisations, see Skill Up.

Developed withAlso on this siteContent category

Source URL

/content/skill-programme-retrain-and-upskill-your-staff

Links

Gain training recognition

How to get recognition and reward for your training efforts through Investors in People and various business awards.

Being recognised as an organisation that invests in its people through training and development can impress prospective customers, suppliers, and new recruits.

Investors in People

If you are seeking recognition for your training efforts and effective engagement with staff, you should consider applying for the Investors in People Awards. Investors in People is a management standard for high performance through people. The prestigious accreditation is recognised across the world as a mark of excellence.

Read more on Investors in People: the Standard for people management.

Recognition through business awards

Business awards run by various organisations and local councils usually have award categories that recognise the efforts of employers to train, develop, and look after their staff. You may find it beneficial to apply for business awards in order to have your training efforts recognised and rewarded.

Find business awards

You can find business awards by checking our business news section or business support finder.

Developed withAlso on this siteContent category

Source URL

/content/gain-training-recognition

Links

Sector-specific skills and training in Northern Ireland

Where to find staff training and skills development specifically tailored to your business sector.

There are several sources of sector-specific advice on skills development for employees working in a particular industry. Employers can also get involved in helping to influence how training is adapted to match the needs of their industries.

Sectoral partnerships

The purpose of sectoral partnerships is to review and develop the content of all youth traineeship and apprenticeship frameworks from level 2 to level 8 to ensure that all those involved in training are industry-ready.

There are 15 sectoral partnerships that have been established so far, including:

- Advanced Manufacturing and Engineering

- Agri-Food Manufacturing

- Built Environment

- Finance and Accounting

- Hair and Beauty

- Health and Social Care

- Hospitality and Tourism

- ICT

- Life and Health Services

- Sales and Marketing

- Business and Administration

- Childcare and Youth Work

- Civil Engineering

- Creative and Cultural

- Motor Vehicle

Employers are encouraged to become involved in sectoral partnerships to ensure apprentices and trainees are getting high-quality training that provides them with the right skills for a career in their chosen industry.

Read more on sectoral partnerships.

Sector Training Councils (STCs)

Sector Training Councils are independent employer representative bodies in Northern Ireland. Their role is to:

- articulate the skills, education, and training needs of their sectors in the short and long term

- advise on training standards required for their sectors

- work with the Department for the Economy (DfE), employers, and industry trade bodies to ensure that training needs and standards are met

You can find out more about individual Sector Training Councils at the links below:

Developed withAlso on this siteContent category

Source URL

/content/sector-specific-skills-and-training-northern-ireland

Links

Staff training

Developing a staff training plan - Grants Electrical Services (video)

Grants Electrical Services, based in Mallusk, explains how they identify staff training needs and put training plans in place to develop staff skills.

Grants Electrical Services Ltd (GES), based in Mallusk, is an electrical and mechanical engineering company. They sell industrial engineering applications to customers throughout the UK and Europe. GES employs approximately 90 staff who specialise in various aspects of niche engineering.

Rachel Doherty explains the approach that GES took to identify staff training needs and develop employee skills. She describes how, following a formal analysis process, they went on to fill gaps in both staff knowledge and skills. This has helped to contribute to the company's growth. Rachel also highlights how GES has developed bespoke in-house leadership and management training that has won industry awards.

Case StudyRachel DohertyContent category

Source URL

/content/developing-staff-training-plan-grants-electrical-services-video

Links

How to identify staff training needs

In this guide:

- Staff training

- Advantages of staff training

- How to identify staff training needs

- Develop a staff training plan

- Training methods to fit your business

- Find training courses in Northern Ireland

- Skill Up programme: Retrain and upskill your staff

- Gain training recognition

- Sector-specific skills and training in Northern Ireland

- Developing a staff training plan - Grants Electrical Services (video)

Advantages of staff training

Find out the many benefits staff training and skills development can bring to your workers and business.

Developing and implementing effective staff training can benefit your employees and your business. By investing in your staff, even on a small training budget, you can drive down costs to your business and help increase sales and profits.

What are the benefits of staff training?

Developing your workforce and improving their skills through training can:

- increase productivity

- enable skills development and spread the skills mix across your teams and organisation

- improve the quality of work