Types of property that must pay business rates and those that are excluded.

Business or non-domestic premises include most commercial properties, such as shops, offices, pubs, warehouses, and factories.

However, there are some types of properties that are specifically excluded from the valuation list and therefore not subject to rates:

Some other non-domestic premises that are exempt or partially exempt from rates include:

If part of a building is used for business and part for residential purposes - such as a shop with a flat above or a solicitor's office in a domestic property - the part used for business counts as non-domestic premises. So, if you live and work on the same premises, you generally pay business rates on the part of the property used for business and domestic rates on the residential part.

Special rules apply to landlords, owners, and tenants depending on the level of Capital Value for domestic properties or Net Annual Value for non-domestic properties. Rental properties and business rates.

If you use your home as a workplace, the part of the property used for work may be liable for business rates. You will still have to pay domestic rates on the rest of the property. Whether you are charged business rates or not depends on the degree of business use. You are more likely to have to pay business rates if a room is used exclusively for business or has been modified, eg as a workshop. Each case is considered individually.

If you have a query regarding your business rates you should contact Land & Property Services.

How rates are calculated for business premises and how to get an idea of what your rate bill may be.

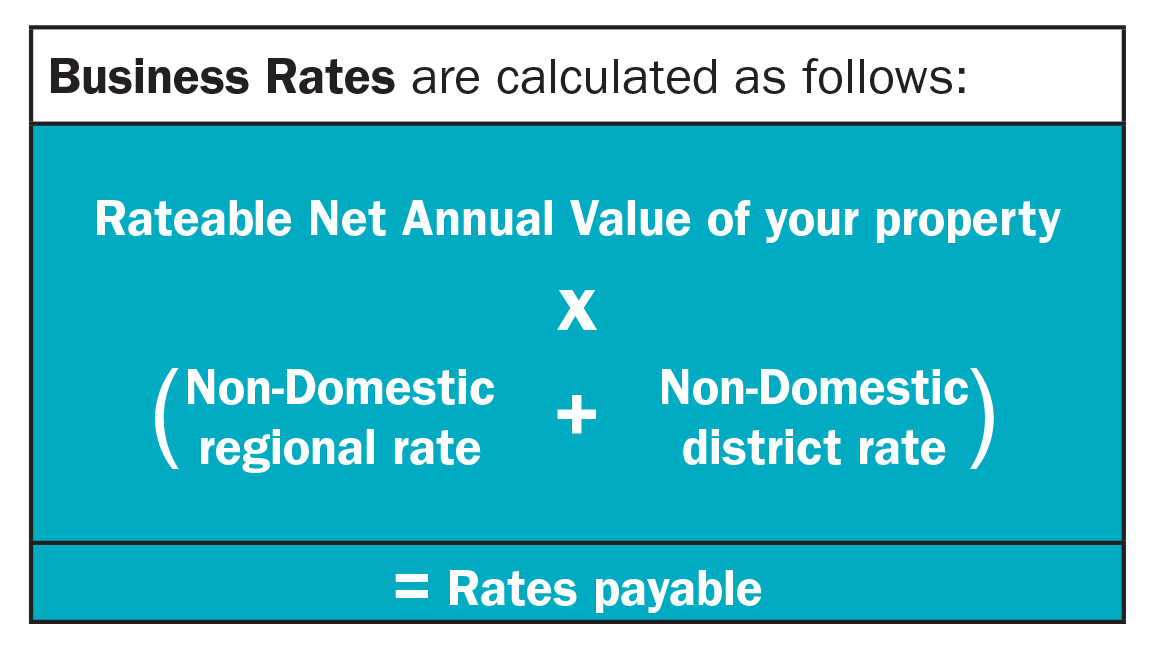

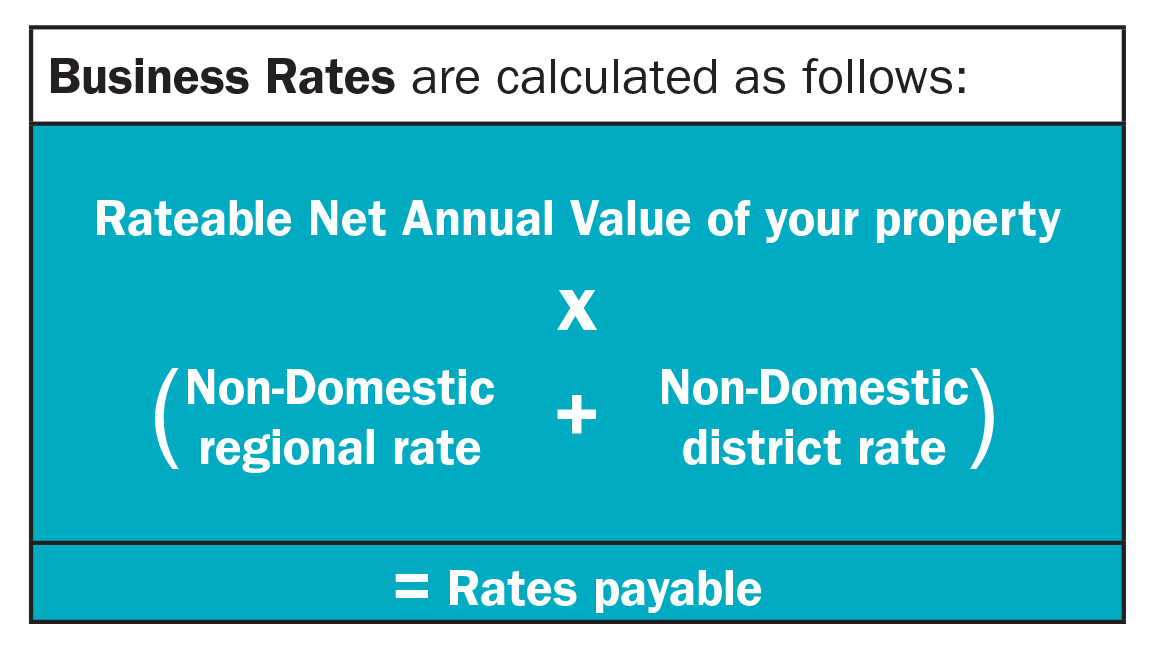

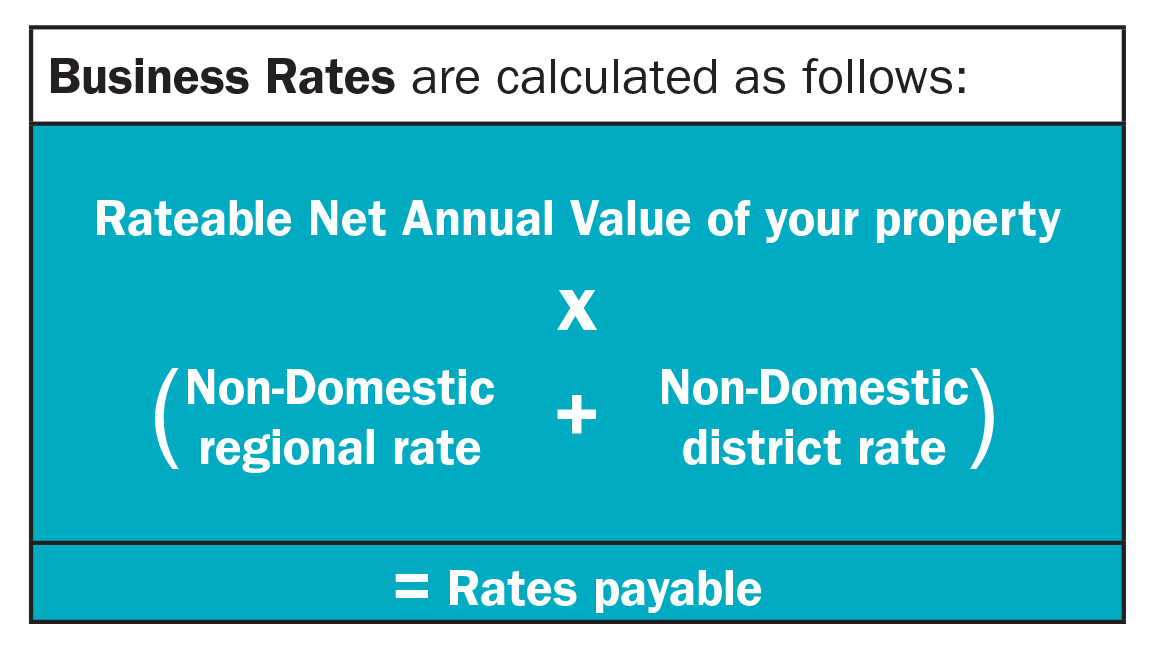

Your rate bill is made up of a number of parts including the regional rate, the district rate and Net Annual Value (NAV). Your rate bill is calculated by multiplying the NAV of your property by the non-domestic rate poundage (non-domestic regional rate + non-domestic district rate) for your council area for the relevant year (as shown below):

The regional rate is set annually by the Northern Ireland Executive and is applied to each district council area in Northern Ireland. The district rate is set annually by each district council in Northern Ireland.

Find the the 2024-25 non-domestic rate poundages for your council area.

Rates for non-domestic or business properties are assessed on their rental value, also known as the Net Annual Value (NAV). NAV is an assessment of the annual rental value that your property could reasonably be expected to be let for if it was on the open market. Each non-domestic property is valued in line with comparable properties in the vicinity.

The current valuation list for non-domestic properties came into operation on 1 April 2023 and is based on rental values as at 1 October 2021.

Find a property valuation for your business premises.

You can view an estimate of a full annual rate bill for the current rating year by inputting the address information using the LPS online valuation search.

Find a property valuation and view your estimated rate bill.

If you have a query regarding business rates or are unsure of your outstanding bill you should contact Land & Property Services.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How business rates are calculated for retail units and how this differs from other types of non-domestic properties.

When calculating business rates for retail units Land & Property Services (LPS) assess the Net Annual Value (NAV) by using zoning. Zoning is a methodology used in assessing the rental value of retail units and is used for shops, hair salons, banks, betting shops and most restaurants. LPS use zoning as it helps take into account different sizes and shapes of shops and awkward layouts.

LPS also consider other parts of the property that are ancillary or tertiary spaces such as upstairs offices and store rooms. They are rated but zoning is not applied for these areas of the property. Some spaces are not considered useable retail areas and are excluded from valuation. These spaces include toilets, lobbies, plant rooms and stairwells.

If you have a query regarding business rates you should contact Land & Property Services.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How business rates are calculated for licensed premises and how this differs from other types of non-domestic properties.

When calculating business rates for licensed premises Land & Property Services (LPS) assess the Net Annual Value (NAV) by calculating the correct level of Fair Maintainable Trade (FMT). LPS does this by collecting information about rent, trading receipts, and trading patterns. LPS analyse this information along with the type of premises, the area it is in, and what services it offers.

As there is little evidence of rents for pubs LPS uses FMT in the assessment to help assess a rateable value or NAV. This is the industry standard and is the approach adopted across the UK.

LPS applies a percentage to the estimated FMT to assess the annual rent. It is based on factors such as, where the premises are located, the sort of premises they are (bar, hotel, etc.), and the sort of trade carried on. LPS regularly consults with trade associations to ensure its approach continues to reflect how the licensed industry operates.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How your business rates are affected if you occupy or leave a property and how to inform Land and Property Services of changes.

When you move into your new property, you must contact your regional Land & Property Services (LPS) Rating office to let them know, otherwise you may receive a backdated rate bill. You can also advise them of how you wish to pay your rate bill.

If you are moving into newly built premises you should contact your local LPS Valuation office. A valuer will come out to assess your property. A rate bill will then be issued based on this valuation. You should be aware that failure to inform LPS could lead to the issue of a backdated rate bill.

You can apply online to have your new property valuation assessed or alternatively you can download the LPS application form (CR3) to have your property valued (PDF, 230K).

This is a writable document, which means that you can complete on screen, print and send to LPS. Alternatively, you can save the document to your desktop, complete the form and send as an attachment to your local LPS Valuation office.

When you move out of your property you must contact LPS. You should have your Account ID, Ratepayer ID and details of the new owners or people in your property to hand.

Alternatively you can use the online form to make changes to your rate account such as personal information, billing address for your rate bill, notification of a ratepayer's death or to change the assessment period for your rate account.

If you have a query regarding business rates you should contact Land & Property Services.

How LPS uses customer data and how they protect this data under the legislation.

Land & Property Services (LPS) fully complies with the Data Protection Act 2018 and the Department of Finance's Data Protection Policy. This means that how LPS collect, store, use, and disclose/share the information you provide to them meets the standards of this legislation.

LPS has a duty to protect public funds and to this end may use the information provided for the prevention and detection of fraud.

LPS participates in the National Fraud Initiative, an exercise that matches electronic data within and between audited bodies to prevent and detect fraud.

The use of data by the Audit Commission does not require the consent of the individuals concerned under the Data Protection Act 2018. However, it is controlled to ensure compliance with data protection and human rights legislation.

For more information contact LPS or Tel 0300 200 7801.

Types of property that must pay business rates and those that are excluded.

Business or non-domestic premises include most commercial properties, such as shops, offices, pubs, warehouses, and factories.

However, there are some types of properties that are specifically excluded from the valuation list and therefore not subject to rates:

Some other non-domestic premises that are exempt or partially exempt from rates include:

If part of a building is used for business and part for residential purposes - such as a shop with a flat above or a solicitor's office in a domestic property - the part used for business counts as non-domestic premises. So, if you live and work on the same premises, you generally pay business rates on the part of the property used for business and domestic rates on the residential part.

Special rules apply to landlords, owners, and tenants depending on the level of Capital Value for domestic properties or Net Annual Value for non-domestic properties. Rental properties and business rates.

If you use your home as a workplace, the part of the property used for work may be liable for business rates. You will still have to pay domestic rates on the rest of the property. Whether you are charged business rates or not depends on the degree of business use. You are more likely to have to pay business rates if a room is used exclusively for business or has been modified, eg as a workshop. Each case is considered individually.

If you have a query regarding your business rates you should contact Land & Property Services.

How rates are calculated for business premises and how to get an idea of what your rate bill may be.

Your rate bill is made up of a number of parts including the regional rate, the district rate and Net Annual Value (NAV). Your rate bill is calculated by multiplying the NAV of your property by the non-domestic rate poundage (non-domestic regional rate + non-domestic district rate) for your council area for the relevant year (as shown below):

The regional rate is set annually by the Northern Ireland Executive and is applied to each district council area in Northern Ireland. The district rate is set annually by each district council in Northern Ireland.

Find the the 2024-25 non-domestic rate poundages for your council area.

Rates for non-domestic or business properties are assessed on their rental value, also known as the Net Annual Value (NAV). NAV is an assessment of the annual rental value that your property could reasonably be expected to be let for if it was on the open market. Each non-domestic property is valued in line with comparable properties in the vicinity.

The current valuation list for non-domestic properties came into operation on 1 April 2023 and is based on rental values as at 1 October 2021.

Find a property valuation for your business premises.

You can view an estimate of a full annual rate bill for the current rating year by inputting the address information using the LPS online valuation search.

Find a property valuation and view your estimated rate bill.

If you have a query regarding business rates or are unsure of your outstanding bill you should contact Land & Property Services.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How business rates are calculated for retail units and how this differs from other types of non-domestic properties.

When calculating business rates for retail units Land & Property Services (LPS) assess the Net Annual Value (NAV) by using zoning. Zoning is a methodology used in assessing the rental value of retail units and is used for shops, hair salons, banks, betting shops and most restaurants. LPS use zoning as it helps take into account different sizes and shapes of shops and awkward layouts.

LPS also consider other parts of the property that are ancillary or tertiary spaces such as upstairs offices and store rooms. They are rated but zoning is not applied for these areas of the property. Some spaces are not considered useable retail areas and are excluded from valuation. These spaces include toilets, lobbies, plant rooms and stairwells.

If you have a query regarding business rates you should contact Land & Property Services.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How business rates are calculated for licensed premises and how this differs from other types of non-domestic properties.

When calculating business rates for licensed premises Land & Property Services (LPS) assess the Net Annual Value (NAV) by calculating the correct level of Fair Maintainable Trade (FMT). LPS does this by collecting information about rent, trading receipts, and trading patterns. LPS analyse this information along with the type of premises, the area it is in, and what services it offers.

As there is little evidence of rents for pubs LPS uses FMT in the assessment to help assess a rateable value or NAV. This is the industry standard and is the approach adopted across the UK.

LPS applies a percentage to the estimated FMT to assess the annual rent. It is based on factors such as, where the premises are located, the sort of premises they are (bar, hotel, etc.), and the sort of trade carried on. LPS regularly consults with trade associations to ensure its approach continues to reflect how the licensed industry operates.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How your business rates are affected if you occupy or leave a property and how to inform Land and Property Services of changes.

When you move into your new property, you must contact your regional Land & Property Services (LPS) Rating office to let them know, otherwise you may receive a backdated rate bill. You can also advise them of how you wish to pay your rate bill.

If you are moving into newly built premises you should contact your local LPS Valuation office. A valuer will come out to assess your property. A rate bill will then be issued based on this valuation. You should be aware that failure to inform LPS could lead to the issue of a backdated rate bill.

You can apply online to have your new property valuation assessed or alternatively you can download the LPS application form (CR3) to have your property valued (PDF, 230K).

This is a writable document, which means that you can complete on screen, print and send to LPS. Alternatively, you can save the document to your desktop, complete the form and send as an attachment to your local LPS Valuation office.

When you move out of your property you must contact LPS. You should have your Account ID, Ratepayer ID and details of the new owners or people in your property to hand.

Alternatively you can use the online form to make changes to your rate account such as personal information, billing address for your rate bill, notification of a ratepayer's death or to change the assessment period for your rate account.

If you have a query regarding business rates you should contact Land & Property Services.

How LPS uses customer data and how they protect this data under the legislation.

Land & Property Services (LPS) fully complies with the Data Protection Act 2018 and the Department of Finance's Data Protection Policy. This means that how LPS collect, store, use, and disclose/share the information you provide to them meets the standards of this legislation.

LPS has a duty to protect public funds and to this end may use the information provided for the prevention and detection of fraud.

LPS participates in the National Fraud Initiative, an exercise that matches electronic data within and between audited bodies to prevent and detect fraud.

The use of data by the Audit Commission does not require the consent of the individuals concerned under the Data Protection Act 2018. However, it is controlled to ensure compliance with data protection and human rights legislation.

For more information contact LPS or Tel 0300 200 7801.

How to set up a Direct Debit to pay Land & Property Services your business rates bill.

Direct Debit is easy to set up and helps you to spread the cost of your business rate bill. Through a new online facility, it is now easy to set up a Direct Debit online. There are three Direct Debit collection dates each month. You can choose from the 7th, 15th, or 28th of each month as your preferred collection date and funds will be collected on or around your chosen date.

Once a Direct Debit has been set up for a rate account, it will continue each year, without further action from you. If you miss Direct Debit payments for two consecutive months, the facility may be withdrawn and you will have to make alternative payment arrangements.

You can also set up your Direct Debit for a single payment and your payment will be taken automatically every year.

Download the Land & Property Services (LPS) information for Direct Debit customers (PDF, 172K).

You can set up a Direct Debit online to pay your rates.

You can also set up a Direct Debit by downloading and completing the Direct Debit application form (PDF, 756K).

Alternatively, you can call the LPS helpline with your bank or building society details and they will set the Direct Debit up for you. You can contact LPS by the following methods:

How to set up online payment for your business rates bill through Billpay.

You can pay your business rates online through the Land & Property Services (LPS) rate payment online site. This service allows you to pay your rate bill by debit card.

When making a rates payment, you will need your LPS Account ID and Ratepayer ID - this is found at the top of your rate bill. You will also need to know the amount you need to pay. LPS information on the rate bill explained for instalment customers (PDF, 211K).

While LPS and their payment provider do not impose a payment limit on the online payment site, some card providers do impose a single transaction limit (commonly around £2,000). If you experience a problem trying to process a large transaction this may be the cause. To avoid this you could try to process the payment in two smaller transactions.

The following debit cards are accepted when paying business rates online:

Please note that LPS is currently unable to accept credit card payments on business rate accounts.

If you have a query regarding your business rates you should contact Land & Property Services.

Pay your business rates bill over the telephone using the Land & Property Services automated payment service.

You can pay your business rate bill over the telephone using the Land & Property Services (LPS) automated payment service. This is available 24 hours a day seven days a week. You can make a payment using a debit card. There is no charge for paying by debit card.

To make a business rates payment by telephone you will need the following information which you can find on your rate bill:

The number to call is 0300 200 7801. Once connected you select the 'payment' option and follow the instructions to make a payment.

While LPS and their payment provider do not impose a payment limit, some card providers do impose a single transaction limit, commonly around £2,000. If you experience a problem trying to process a large transaction this may be the cause. To avoid this you could try to process the payment in two smaller transactions. This will not affect your entitlement to an early payment discount.

The following debit cards are accepted:

Please note that LPS is currently unable to accept credit card payments on business rate accounts.

If you have a query regarding your business rates you should contact Land & Property Services.

How you can pay your business rates bill using internet banking or telephone banking.

If your bank or building society offers telephone and/or internet banking, you can pay your business rate bill using either of these payment methods.

You must quote the full 16-digit reference number which is made up of your Account ID and Ratepayer ID and can be found at the top right-hand corner of your rate bill. You must include the zeros at the beginning with no spaces or dashes, for example, 0123456789105568.

If you have a query regarding your business rates you should contact Land & Property Services.

Bank account details if you want to pay your business rates bill through Bacs or CHAPs payment.

To make a Bacs payment ratepayers must provide their Rate Reference number (Account ID or Occupancy ID, followed by Ratepayer ID).

To enable the correct allocation of payment(s), any remittance or Bacs query has to be sent to: commercial.lps@finance-ni.gov.uk

The bank details are:

Danske Bank

Donegall Square West

BELFAST

BT1 6JS

If payment is coming from abroad, the LPS IBAN number for non-domestic rate accounts is as follows:

CHAPs payments can also be used when a payment needs to be made quickly. There is a charge for making payments this way but it usually depends on the bank and the amount of money being transferred. It can be around £25 or more.

If you have a query regarding your business rates you should contact Land & Property Services.

How to set up a standing order to pay Land & Property Services your business rates bill.

You can get your bank or building society to set up a standing order from your account to pay your business rates. The payment should be made to Land & Property Services (LPS) as follows:

You must quote the full 16-digit reference number which is made up of your Account ID and Ratepayer ID and can be found at the top right-hand corner of your business rate bill. You must include the zeros at the beginning with no spaces or dashes, for example, 0123456789105568.

You should be aware that a standing order has to be renewed each year, unlike a Direct Debit which runs continuously until cancelled.

Download the LPS information on the rate bill explained for instalment customers (PDF, 211K).

If you have a query regarding your business rates you should contact Land & Property Services.

How to pay your business rate bill at a Post Office or PayPoint outlet.

You may find it more convenient to pay your business rate bill in a local Post Office or shop that offers the PayPoint service.

As well as the network of Post Offices, there are over 450 PayPoint outlets in Northern Ireland, including garages, newsagents, and convenience stores where you can pay your rate bill.

You can choose to pay by cheque, cash, or debit card. However, you should be aware that some PayPoint outlets may not accept payment by cheque. You can pay in full, in one single payment or you can pay in instalments. You must allow five working days for any payment to reach Land & Property Services (LPS).

You will need the barcode on your rate bill to make payment. You should bring your rate bill with you so you will know how much you need to pay. Remember to retain your receipt.

Please be aware that PayPoint imposes a transaction limit of £300 per transaction and the Post Office imposes a transaction limit of £4,000 (for fraud purposes). If you wish to make a larger payment than the transaction limit, it can be processed in two payments. Alternatively, if you are paying a large amount, you may wish to consider an alternative payment method such as direct debit, standing order, internet banking, or payment online.

Download the LPS information on the rate bill explained for instalment customers (PDF, 211K).

If you have a query regarding your business rates you should contact Land & Property Services.

How to pay your business rates bill by cheque.

If paying your business rate bill by cheque you should make your cheque payable to 'Land & Property Services', cross it 'Rate Account', and send it to the below address only:

Land & Property Services

Lanyon Plaza

7 Lanyon Place

Town Parks

Belfast

BT1 3LP

You should clearly print the address of the property for which the business rates are due and your Account ID and Ratepayer ID number on the back of the cheque.

A receipt will not be issued for postal payments.

Download the LPS information on the rate bill explained for instalment customers (PDF, 211K).

If you have a query regarding your business rates you should contact Land & Property Services.

What you should do if you can't pay your business rates bill.

Payment of rates is a legal obligation. If you are not able to pay your rate bill you must contact Land & Property Services (LPS) immediately.

If you owe rates and do not have a payment arrangement in place, the best thing you can do is to contact LPS to discuss the options available that will help legal recovery action. The easiest way to get in touch with LPS is to complete LPS's online contact form.

Alternatively, you can contact LPS using the following methods:

There are a variety of reliefs available to support business ratepayers. You can find out more about these at help available for business rates.

To understand the consequences if you don't pay your business rates see what happens if I don't pay my rate bill?

Action that may be taken by Land & Property Services if you fail to pay your business rates.

Land & Property Services (LPS) is responsible for collecting rates in Northern Ireland that are due for payment. Payment of rates is a legal obligation. There are a number of measures available to LPS to recover rates that are unpaid.

If you do not pay your rates or contact LPS to make an arrangement to clear your account, you will be taken to court. This will mean:

If you are having problems paying your rate bill you should inform LPS immediately. See what happens if I can't pay my rate bill?

If you pay by monthly instalments and miss a payment, LPS will issue a reminder for the amount due. If you pay this within seven days, the instalment payment option remains in place. If you can't pay the arrears within seven days, you should contact your local LPS rating office, as it may be possible to make different payment arrangements.

If you are not set up for instalments, you will receive a final notice 40 days after the original rate bill was issued.

When you receive a final notice for payment of your business rate bill, you lose the automatic right to pay by instalments and you have ten days to pay the full amount outstanding. You can however still contact LPS who may be able to agree to a suitable payment plan.

If you do not pay the whole amount due or do not make a payment agreement with LPS, they will take you to court by issuing a Process in Debt Proceedings and charge you extra costs without issuing any further reminders.

If you receive a process to attend court and pay the full amount and any extra costs before the court date, LPS will not take any further action. If you don't pay the full amount and additional costs, the case will go to the Magistrate's Court on the day stated.

Once proceedings have been issued, LPS cannot make an agreement with you. However, if possible you should continue to make payments to reduce the debt.

You do not have to attend the court hearing unless you wish to dispute the amount or you have a legal matter to bring to the attention of the Magistrate. The court will usually award a decree if you do not attend and you will receive notification of this after the hearing. To avoid further legal recovery action, after you receive this notification you should contact LPS to make an arrangement to pay the outstanding amount.

If you are a sole trader and if you do not clear the outstanding amount or make an arrangement to pay this, LPS will issue a Notice of Intention to lodge the debt with the Enforcement of Judgments Office (EJO). If you do not pay the outstanding balance with additional costs within ten days, LPS will lodge the debt for enforcement with the EJO.

Lodgement of the debt with the Enforcement of Judgements Office could result in the following:

If you are a limited company with debt over £750 or an individual with debt over £5000 and you do not clear the outstanding amount or make an arrangement to pay this LPS can issue a Statutory Demand. If you do not comply with this, LPS will initiate bankruptcy/liquidation proceedings. See managing financial difficulty.

If you have a query regarding your business rates you should contact Land & Property Services.

How to set up a Direct Debit to pay Land & Property Services your business rates bill.

Direct Debit is easy to set up and helps you to spread the cost of your business rate bill. Through a new online facility, it is now easy to set up a Direct Debit online. There are three Direct Debit collection dates each month. You can choose from the 7th, 15th, or 28th of each month as your preferred collection date and funds will be collected on or around your chosen date.

Once a Direct Debit has been set up for a rate account, it will continue each year, without further action from you. If you miss Direct Debit payments for two consecutive months, the facility may be withdrawn and you will have to make alternative payment arrangements.

You can also set up your Direct Debit for a single payment and your payment will be taken automatically every year.

Download the Land & Property Services (LPS) information for Direct Debit customers (PDF, 172K).

You can set up a Direct Debit online to pay your rates.

You can also set up a Direct Debit by downloading and completing the Direct Debit application form (PDF, 756K).

Alternatively, you can call the LPS helpline with your bank or building society details and they will set the Direct Debit up for you. You can contact LPS by the following methods:

How to set up online payment for your business rates bill through Billpay.

You can pay your business rates online through the Land & Property Services (LPS) rate payment online site. This service allows you to pay your rate bill by debit card.

When making a rates payment, you will need your LPS Account ID and Ratepayer ID - this is found at the top of your rate bill. You will also need to know the amount you need to pay. LPS information on the rate bill explained for instalment customers (PDF, 211K).

While LPS and their payment provider do not impose a payment limit on the online payment site, some card providers do impose a single transaction limit (commonly around £2,000). If you experience a problem trying to process a large transaction this may be the cause. To avoid this you could try to process the payment in two smaller transactions.

The following debit cards are accepted when paying business rates online:

Please note that LPS is currently unable to accept credit card payments on business rate accounts.

If you have a query regarding your business rates you should contact Land & Property Services.

Pay your business rates bill over the telephone using the Land & Property Services automated payment service.

You can pay your business rate bill over the telephone using the Land & Property Services (LPS) automated payment service. This is available 24 hours a day seven days a week. You can make a payment using a debit card. There is no charge for paying by debit card.

To make a business rates payment by telephone you will need the following information which you can find on your rate bill:

The number to call is 0300 200 7801. Once connected you select the 'payment' option and follow the instructions to make a payment.

While LPS and their payment provider do not impose a payment limit, some card providers do impose a single transaction limit, commonly around £2,000. If you experience a problem trying to process a large transaction this may be the cause. To avoid this you could try to process the payment in two smaller transactions. This will not affect your entitlement to an early payment discount.

The following debit cards are accepted:

Please note that LPS is currently unable to accept credit card payments on business rate accounts.

If you have a query regarding your business rates you should contact Land & Property Services.

How you can pay your business rates bill using internet banking or telephone banking.

If your bank or building society offers telephone and/or internet banking, you can pay your business rate bill using either of these payment methods.

You must quote the full 16-digit reference number which is made up of your Account ID and Ratepayer ID and can be found at the top right-hand corner of your rate bill. You must include the zeros at the beginning with no spaces or dashes, for example, 0123456789105568.

If you have a query regarding your business rates you should contact Land & Property Services.

Bank account details if you want to pay your business rates bill through Bacs or CHAPs payment.

To make a Bacs payment ratepayers must provide their Rate Reference number (Account ID or Occupancy ID, followed by Ratepayer ID).

To enable the correct allocation of payment(s), any remittance or Bacs query has to be sent to: commercial.lps@finance-ni.gov.uk

The bank details are:

Danske Bank

Donegall Square West

BELFAST

BT1 6JS

If payment is coming from abroad, the LPS IBAN number for non-domestic rate accounts is as follows:

CHAPs payments can also be used when a payment needs to be made quickly. There is a charge for making payments this way but it usually depends on the bank and the amount of money being transferred. It can be around £25 or more.

If you have a query regarding your business rates you should contact Land & Property Services.

How to set up a standing order to pay Land & Property Services your business rates bill.

You can get your bank or building society to set up a standing order from your account to pay your business rates. The payment should be made to Land & Property Services (LPS) as follows:

You must quote the full 16-digit reference number which is made up of your Account ID and Ratepayer ID and can be found at the top right-hand corner of your business rate bill. You must include the zeros at the beginning with no spaces or dashes, for example, 0123456789105568.

You should be aware that a standing order has to be renewed each year, unlike a Direct Debit which runs continuously until cancelled.

Download the LPS information on the rate bill explained for instalment customers (PDF, 211K).

If you have a query regarding your business rates you should contact Land & Property Services.

How to pay your business rate bill at a Post Office or PayPoint outlet.

You may find it more convenient to pay your business rate bill in a local Post Office or shop that offers the PayPoint service.

As well as the network of Post Offices, there are over 450 PayPoint outlets in Northern Ireland, including garages, newsagents, and convenience stores where you can pay your rate bill.

You can choose to pay by cheque, cash, or debit card. However, you should be aware that some PayPoint outlets may not accept payment by cheque. You can pay in full, in one single payment or you can pay in instalments. You must allow five working days for any payment to reach Land & Property Services (LPS).

You will need the barcode on your rate bill to make payment. You should bring your rate bill with you so you will know how much you need to pay. Remember to retain your receipt.

Please be aware that PayPoint imposes a transaction limit of £300 per transaction and the Post Office imposes a transaction limit of £4,000 (for fraud purposes). If you wish to make a larger payment than the transaction limit, it can be processed in two payments. Alternatively, if you are paying a large amount, you may wish to consider an alternative payment method such as direct debit, standing order, internet banking, or payment online.

Download the LPS information on the rate bill explained for instalment customers (PDF, 211K).

If you have a query regarding your business rates you should contact Land & Property Services.

How to pay your business rates bill by cheque.

If paying your business rate bill by cheque you should make your cheque payable to 'Land & Property Services', cross it 'Rate Account', and send it to the below address only:

Land & Property Services

Lanyon Plaza

7 Lanyon Place

Town Parks

Belfast

BT1 3LP

You should clearly print the address of the property for which the business rates are due and your Account ID and Ratepayer ID number on the back of the cheque.

A receipt will not be issued for postal payments.

Download the LPS information on the rate bill explained for instalment customers (PDF, 211K).

If you have a query regarding your business rates you should contact Land & Property Services.

What you should do if you can't pay your business rates bill.

Payment of rates is a legal obligation. If you are not able to pay your rate bill you must contact Land & Property Services (LPS) immediately.

If you owe rates and do not have a payment arrangement in place, the best thing you can do is to contact LPS to discuss the options available that will help legal recovery action. The easiest way to get in touch with LPS is to complete LPS's online contact form.

Alternatively, you can contact LPS using the following methods:

There are a variety of reliefs available to support business ratepayers. You can find out more about these at help available for business rates.

To understand the consequences if you don't pay your business rates see what happens if I don't pay my rate bill?

Action that may be taken by Land & Property Services if you fail to pay your business rates.

Land & Property Services (LPS) is responsible for collecting rates in Northern Ireland that are due for payment. Payment of rates is a legal obligation. There are a number of measures available to LPS to recover rates that are unpaid.

If you do not pay your rates or contact LPS to make an arrangement to clear your account, you will be taken to court. This will mean:

If you are having problems paying your rate bill you should inform LPS immediately. See what happens if I can't pay my rate bill?

If you pay by monthly instalments and miss a payment, LPS will issue a reminder for the amount due. If you pay this within seven days, the instalment payment option remains in place. If you can't pay the arrears within seven days, you should contact your local LPS rating office, as it may be possible to make different payment arrangements.

If you are not set up for instalments, you will receive a final notice 40 days after the original rate bill was issued.

When you receive a final notice for payment of your business rate bill, you lose the automatic right to pay by instalments and you have ten days to pay the full amount outstanding. You can however still contact LPS who may be able to agree to a suitable payment plan.

If you do not pay the whole amount due or do not make a payment agreement with LPS, they will take you to court by issuing a Process in Debt Proceedings and charge you extra costs without issuing any further reminders.

If you receive a process to attend court and pay the full amount and any extra costs before the court date, LPS will not take any further action. If you don't pay the full amount and additional costs, the case will go to the Magistrate's Court on the day stated.

Once proceedings have been issued, LPS cannot make an agreement with you. However, if possible you should continue to make payments to reduce the debt.

You do not have to attend the court hearing unless you wish to dispute the amount or you have a legal matter to bring to the attention of the Magistrate. The court will usually award a decree if you do not attend and you will receive notification of this after the hearing. To avoid further legal recovery action, after you receive this notification you should contact LPS to make an arrangement to pay the outstanding amount.

If you are a sole trader and if you do not clear the outstanding amount or make an arrangement to pay this, LPS will issue a Notice of Intention to lodge the debt with the Enforcement of Judgments Office (EJO). If you do not pay the outstanding balance with additional costs within ten days, LPS will lodge the debt for enforcement with the EJO.

Lodgement of the debt with the Enforcement of Judgements Office could result in the following:

If you are a limited company with debt over £750 or an individual with debt over £5000 and you do not clear the outstanding amount or make an arrangement to pay this LPS can issue a Statutory Demand. If you do not comply with this, LPS will initiate bankruptcy/liquidation proceedings. See managing financial difficulty.

If you have a query regarding your business rates you should contact Land & Property Services.

Types of property that must pay business rates and those that are excluded.

Business or non-domestic premises include most commercial properties, such as shops, offices, pubs, warehouses, and factories.

However, there are some types of properties that are specifically excluded from the valuation list and therefore not subject to rates:

Some other non-domestic premises that are exempt or partially exempt from rates include:

If part of a building is used for business and part for residential purposes - such as a shop with a flat above or a solicitor's office in a domestic property - the part used for business counts as non-domestic premises. So, if you live and work on the same premises, you generally pay business rates on the part of the property used for business and domestic rates on the residential part.

Special rules apply to landlords, owners, and tenants depending on the level of Capital Value for domestic properties or Net Annual Value for non-domestic properties. Rental properties and business rates.

If you use your home as a workplace, the part of the property used for work may be liable for business rates. You will still have to pay domestic rates on the rest of the property. Whether you are charged business rates or not depends on the degree of business use. You are more likely to have to pay business rates if a room is used exclusively for business or has been modified, eg as a workshop. Each case is considered individually.

If you have a query regarding your business rates you should contact Land & Property Services.

How rates are calculated for business premises and how to get an idea of what your rate bill may be.

Your rate bill is made up of a number of parts including the regional rate, the district rate and Net Annual Value (NAV). Your rate bill is calculated by multiplying the NAV of your property by the non-domestic rate poundage (non-domestic regional rate + non-domestic district rate) for your council area for the relevant year (as shown below):

The regional rate is set annually by the Northern Ireland Executive and is applied to each district council area in Northern Ireland. The district rate is set annually by each district council in Northern Ireland.

Find the the 2024-25 non-domestic rate poundages for your council area.

Rates for non-domestic or business properties are assessed on their rental value, also known as the Net Annual Value (NAV). NAV is an assessment of the annual rental value that your property could reasonably be expected to be let for if it was on the open market. Each non-domestic property is valued in line with comparable properties in the vicinity.

The current valuation list for non-domestic properties came into operation on 1 April 2023 and is based on rental values as at 1 October 2021.

Find a property valuation for your business premises.

You can view an estimate of a full annual rate bill for the current rating year by inputting the address information using the LPS online valuation search.

Find a property valuation and view your estimated rate bill.

If you have a query regarding business rates or are unsure of your outstanding bill you should contact Land & Property Services.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How business rates are calculated for retail units and how this differs from other types of non-domestic properties.

When calculating business rates for retail units Land & Property Services (LPS) assess the Net Annual Value (NAV) by using zoning. Zoning is a methodology used in assessing the rental value of retail units and is used for shops, hair salons, banks, betting shops and most restaurants. LPS use zoning as it helps take into account different sizes and shapes of shops and awkward layouts.

LPS also consider other parts of the property that are ancillary or tertiary spaces such as upstairs offices and store rooms. They are rated but zoning is not applied for these areas of the property. Some spaces are not considered useable retail areas and are excluded from valuation. These spaces include toilets, lobbies, plant rooms and stairwells.

If you have a query regarding business rates you should contact Land & Property Services.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How business rates are calculated for licensed premises and how this differs from other types of non-domestic properties.

When calculating business rates for licensed premises Land & Property Services (LPS) assess the Net Annual Value (NAV) by calculating the correct level of Fair Maintainable Trade (FMT). LPS does this by collecting information about rent, trading receipts, and trading patterns. LPS analyse this information along with the type of premises, the area it is in, and what services it offers.

As there is little evidence of rents for pubs LPS uses FMT in the assessment to help assess a rateable value or NAV. This is the industry standard and is the approach adopted across the UK.

LPS applies a percentage to the estimated FMT to assess the annual rent. It is based on factors such as, where the premises are located, the sort of premises they are (bar, hotel, etc.), and the sort of trade carried on. LPS regularly consults with trade associations to ensure its approach continues to reflect how the licensed industry operates.

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

How your business rates are affected if you occupy or leave a property and how to inform Land and Property Services of changes.

When you move into your new property, you must contact your regional Land & Property Services (LPS) Rating office to let them know, otherwise you may receive a backdated rate bill. You can also advise them of how you wish to pay your rate bill.

If you are moving into newly built premises you should contact your local LPS Valuation office. A valuer will come out to assess your property. A rate bill will then be issued based on this valuation. You should be aware that failure to inform LPS could lead to the issue of a backdated rate bill.

You can apply online to have your new property valuation assessed or alternatively you can download the LPS application form (CR3) to have your property valued (PDF, 230K).

This is a writable document, which means that you can complete on screen, print and send to LPS. Alternatively, you can save the document to your desktop, complete the form and send as an attachment to your local LPS Valuation office.

When you move out of your property you must contact LPS. You should have your Account ID, Ratepayer ID and details of the new owners or people in your property to hand.

Alternatively you can use the online form to make changes to your rate account such as personal information, billing address for your rate bill, notification of a ratepayer's death or to change the assessment period for your rate account.

If you have a query regarding business rates you should contact Land & Property Services.

How LPS uses customer data and how they protect this data under the legislation.

Land & Property Services (LPS) fully complies with the Data Protection Act 2018 and the Department of Finance's Data Protection Policy. This means that how LPS collect, store, use, and disclose/share the information you provide to them meets the standards of this legislation.

LPS has a duty to protect public funds and to this end may use the information provided for the prevention and detection of fraud.

LPS participates in the National Fraud Initiative, an exercise that matches electronic data within and between audited bodies to prevent and detect fraud.

The use of data by the Audit Commission does not require the consent of the individuals concerned under the Data Protection Act 2018. However, it is controlled to ensure compliance with data protection and human rights legislation.

For more information contact LPS or Tel 0300 200 7801.

Find out if you need planning permission for your bed and breakfast, self catering or other tourism business.

If you plan to open a small bed and breakfast in your own home, you may not need planning permission to start your business. The key test to decide if you need planning permission is whether you will change the overall nature of the house. For example, a building changing from a private home to business premises.

If your home will no longer be used mainly as a private residence, and your business activities will affect the area where you live then you will likely need planning consent for a change of use. Things affecting the local area include disturbance to neighbours and increased footfall.

You only need planning permission if the new building use is classed differently from the current one. For example, changing the building from a greengrocer to a shoe shop will not need planning permission as both are classed as shops. However, if you're changing a home into a guest house then you will need planning permission.

Contact your council’s local planning office for advice.

If you are agreeing a lease or buying a new property for your accommodation start-up, you should consider in advance if you need to get planning permission for your intended use. Also think about what your chances of getting it are. Contact your local area planning office for their advice at an early stage.

Building regulations apply if you plan to:

These rules set standards on the safety and stability of any building work.

If you're planning on carrying out work on your premises, you must apply with your local Building Control Office.

Find out if you need to pay business rates serviced or self catering accommodation premises.

If you operate bed and breakfast or self-catering accommodation, you may need to pay business rates.

If you operate a bed and breakfast you may have to pay both non-domestic rates, on the portion used for guest accommodation, and domestic rates on the portion used for owner/staff accommodation. See business rates.

Business rates do not apply to a bed and breakfast where:

Business rates do not apply to a self-catering accommodation where:

If you have to pay business rates, but use your property for business and domestic purposes, only the part you use for business purposes is subject to business rates. You will have to pay domestic rates for the residential part of the property.

Find out if you need permission to display tourism signs or advertisements for your business.

If you display any outdoor signs or advertisements you may need to apply to the planning authority for consent. Whether you need consent from the planning authority depends on whether your signs are fully, partially or not lit-up and where you place them.

If your property is listed or lies within a conservation area you may need further consent. You could also be more restricted in the types of signs you can display.

You will also need to ensure that any signs you display are not misleading. This could be a breach of fair trading rules, as well as marketing laws.

If you wish to apply for brown tourism signposting, you should contact the Roads Department of your local council, who will advise you about:

Tourism Northern Ireland provide information about brown signs.

An outline of health and safety obligations specific to tourism businesses.

As a tourist accommodation provider, you are responsible for health and safety of your guests whilst they are on your premises.

Your health and safety obligations extend to not only to guests, but to anyone on your premises, including staff.

For more general guidance on health and safety, see health and safety.

You have a 'duty of care' to guests and other visitors. You must make sure that premises are reasonably safe for purpose.. If you don't take precautions to ensure reasonable safety of the premises, you can be sued for compensation or prosecuted.

To make premises 'reasonably safe', you should take common sense precautions such as:

If certain parts of your premises, such as the kitchen or the store room, are clearly marked out of bounds to guests, your duty of care may not extend to these areas.

You may be held liable for accidents caused as a result of the actions of your staff or other guests. However, your guests also have a duty to take care of their own safety. If they have an accident due to their own negligence, or while doing something you wouldn't reasonably expect them to do, your liability for the accident may be reduced or overridden.

As part of your health and safety responsibilities, you will need to report certain accidents involving your guests or staff. See first aid, accidents and ill health in the workplace.

For on outline of your health and safety duties to your staff, see employer's health and safety responsibilities.

You are also legally required to have insurance to cover your liability for any bodily injury or disease sustained by an employee at work. See liability insurance for your business.

Whilst it's not a legal requirement, you should consider taking out additional insurance to cover your liability to your guests. See public liability insurance.

If a guest or a member of your staff has made a claim against you, you should seek legal advice. Find a solicitor.

Fire, gas and electricity safety laws that tourist accommodation businesses must comply with.

All accommodation businesses, regardless of their size, have to comply with safety laws relating to fire, gas and electricity.

All businesses must:

Fire risk assessment is the foundation for all the fire safety measures you need on the premises. It is essential to keep your business and your guests safe. See fire safety and risk assessment.

If you are providing self-catering accommodation that contains upholstered furniture, your furniture must comply with certain safety tests:

All new upholstered furniture (except mattresses and bedding) and loose and stretch covers for furniture must carry a permanent label detailing compliance with fire safety requirements. Always look for these labels before buying any upholstered furniture for your property.

You could consider buying furniture designed to cope with a greater fire hazard (eg hotel beds and chairs). When re-equipping your self-catering property, it will normally be for you to decide if you require the new furniture to meet these higher fire resistance standards. If you are in doubt, check with your local fire authority.

Electrical safety laws apply to most electrical equipment in your accommodation. This includes:

The laws apply to new and second-hand equipment equally.

If you are making the equipment available for your guests to use, you will be liable for their safety. For electrical equipment to be regarded as safe, there should be no risk (or only a minimal risk) that the equipment could cause death or injury to any person, or cause damage to property.

Whilst not a legal requirement, you should regularly check and service the electrical goods you supply in your accommodation to ensure their safety.

You must have gas appliances, installation pipework or flue installed in your premises in accordance with manufacturer's instructions. You must maintain them in a safe condition. A Gas Safe engineer must inspect them at least once a year.

Information to help you comply with food safety laws if you offer food or drink to your guests.

If you wish to carry out any 'food operations' in the course of your accommodation business, you must register your premises with your local council's environmental health department. You must do so at least 28 days before your business opens.

Food operations include selling, cooking, storing, handling, preparing and distributing food and drink.

If you're serving food to your guests, you also need to ensure that you comply with other relevant laws relating to food safety, hygiene and labelling. Find detailed information on each below.

If you wish to sell alcohol on your premises, you will need an alcohol licence.

Disability and discrimination laws for accommodation providers and what they mean for your business.

If you provide any sort of accommodation in Northern Ireland, serviced or self-catering, you have duties under the Disability Discrimination Act (DDA).

Under this law, you must not discriminate against disabled people using your goods, facilities or services. You must treat everyone fairly, regardless of their:

You can't refuse to serve people with disabilities or provide them a lower standard of service, unless this can be justified.

You may need to make 'reasonable adjustments' to any barriers that may prevent a person with disabilities using or accessing their service.

What is 'reasonable' will depend on a number of factors, including the cost of an adjustment. Think ahead and take steps to address barriers that impede disabled people. This can include:

See disabled access and facilities in business premises.

The Equality Commission offer advice and information to service providers on their duties under equality law.

Employment law and best practice resources that can help you run your tourism business lawfully and efficiently.

If you employ staff in your tourism business, or are thinking of doing so in the future, there are a number of things that you will need to consider.

The guides below can help you comply with the relevant employment laws, and provide you with best practice know-how for managing your staff:

Why you must keep a guest register if you run a hotel, bed and breakfast, hostel or any other accommodation business, and what you need to record in it.

If you run a serviced or self-catering accommodation business, you must keep a record of all guests over the age of 16. This can take the form of a registration form, or can be recorded electronically.

You must keep each guest's details for at least 12 months and have the register available for inspection by police or other authorised persons at all time.

On guests' arrival, you need to record:

If your guests are using your car parking facilities, you may also want to take record of the registration number of their car. However, you aren't legally required to do so.

When keeping a guest register, even if it's just names and contact details, you must protect your guests' privacy under the Data Protection Act 2018 and UK General Data Protection Regulation (UK GDPR).

The rules for reselling gas and electricity, charging for telephone calls and providing water from private supply.

When you're running a tourist accommodation business, the costs and responsibilities of providing utilities to your guests are one of the factors you will need to consider.

If you are reselling electricity to your guests that has already been bought from an authorised electricity supplier, the most you can charge is limited by law.

You can only resell electricity at the same price you bought it. You are not allowed to charge guests more money for electricity than you paid for it.

This rule does not apply if you charge your guests an inclusive charge for accommodation, eg one that includes 'all amenities' and does not specify separate charge for electricity.

As with electricity, you may only resell gas at the same price that you bought it. You aren't allowed to charge your guests more for gas than you originally paid for it.

Download guidance for resellers of electricity and gas (PDF, 307KB).

If you use or provide water from a private supply to other people in the course of your business, eg by renting out holiday accommodation or using water for food production, you have a duty of care towards these people for the safety of the water you supply.

In these circumstances, you must register your supply with the Northern Ireland Drinking Water Inspectorate (DWI).

Once you register your private water supply, the DWI will assess it for contamination risk and place it on a monitoring programme to check that it meets the water quality standards.

As a matter of good practice, you should be as open as possible with guests about telephone charges.

You should indicate clearly typical usage rates for bedroom telephones. These should include examples of costs per unit and length of time that unit represents.

You should display charges for:

Your responsibilities for safekeeping, and your rights to retain, your guest's belongings.

If you run serviced accommodation, such as a bed and breakfast or a hotel, you must take responsibility for looking after your guest's luggage. In some cases, you may have the legal right to keep your guest's luggage if they don't pay their bill.

If you run a hotel and have a guest for at least one night, you could be liable for loss and damage to your guest's property. This will depend on certain factors:

If your guest didn't stay overnight and was, for example, simply visiting the restaurant or bar, you will usually be liable for the loss of or damage to your guest's property only if:

In certain circumstances, serviced accommodation providers may have the right to detain a guest's luggage.

The owner of a hotel (as defined in the Hotel Proprietors Act (Northern Ireland) 1958) has the legal right to keep a guest's property until the guest settles their bill. This does not include the guest's car or property left in it; or clothes that the guest is wearing.

When the guest settles their bill, you must return the property to them. You cannot charge for storage. You must reimburse the guest if the property has been damaged while you had it.

If the bill has not been paid in full after six weeks, you may sell the guest's property at a public auction, advertised at least four weeks in advance. If the sale makes more money than what is owed to you (including the costs of advertising and organising the auction), you must return the excess to the guest.

Another option for getting what's owed to you is claiming it through the small claims procedure.

All tourist accommodation businesses must keep a guest register – be aware of your responsibilities to keep this data secure.

All serviced and self-catering accommodation premises must keep a record of all guests over the age of 16. The record should include full name and nationality. See keeping a guest register in your tourist accommodation business.

When keeping a guest register, even if it's just names and contact details, you must protect your guests' privacy under data protection law. The UK General Data Protection Regulation (UK GDPR) sets out the key principles, rights and obligations for processing of personal data.

If you handle customer's credit/debit card number, you must follow the standards of the Payment Card Industry Security Standards Council. The standard is applicable to any organisation that stores, transmits or processes cardholder information.

Find out how to protect your customers and achieve the Payment Card Industry Data Security Standard (PCI DSS) compliance; See accepting online payments.

Guidance on who is responsible for paying business rates for rental properties and details of the 10% landlord allowance.

Landlords, owners, and tenants are often not fully aware of who is responsible for rate payments on rental properties.

Rates for rental properties are governed by Article 20 of The Rates (Northern Ireland) Order 1977 (amended 2006) and must be considered different from owner-occupied properties.

Liability for rates on a rental property is determined by the Capital Value for Domestic Properties or Net Annual Value for Non-Domestic Properties.

Since 1 April 2015, the amount of allowance given to landlords has been standardised at 10% for both Article 20 and Article 21 types of rate accounts. This level of allowance applies across the board to all landlords.

The table below gives details of who is responsible for paying rates on domestic rental properties, for example, houses and flats.

|

Capital Value of the property |

Rental Properties |

House in Multiple Occupation (property which is let to three or more tenants from two or more families - for example student house) |

|---|---|---|

| £150,000 or less |

Landlord Pays |

Landlord Pays |

| Greater than £150,000 |

Tenant Pays (unless the landlord has signed up to a formal agreement under Article 21 with the department to pay rates) To sign up under Article 21, an application form must be submitted. |

Landlord Pays |

Download the LPS application form and guidance notes for the 10% Landlord Allowance (PDF, 567K).

The table below gives details of who is responsible for paying rates on non-domestic rental properties, for example, shops and offices.

| Net Annual Value (shown on rate bill) (Find the Net Annual Value (NAV) of your property) |

Frequency of rent payment | Who Pays? |

|---|---|---|

|

£0 - £750 |

Any Frequency | Owner (landlord) |

| £751-£1590 | Monthly or weekly (less than quarterly) | Owner (landlord) |

| £751-£1590 | Quarterly or longer | Occupier (tenant) |

| £1591 and above | N/A | Occupier (tenant) |

To apply for an Article 21 Landlord Allowance, please complete the application form below and send to:

Land & Property Services

Central Landlords Team

Lanyon Plaza

7 Lanyon Place

Town Parks

Belfast

BT1 3LP

Download the LPS application form and guidance notes for the 10% Landlord Allowance (PDF, 567K).

If you wish to add another rental property to your portfolio, you must detail your request in writing and send it to LPS at the address above or by email to: landlords@lpsni.gov.uk

If the ownership of one of your properties changes you must inform LPS immediately otherwise you will continue to receive a rate bill for this property. You must send written confirmation of the change of ownership to LPS including a copy of the solicitor's letter showing:

You must send LPS this written confirmation to the following address:

Land & Property Services

Central Landlords Team

Lanyon Plaza

7 Lanyon Place

Town Parks

Belfast

BT1 3LP

or by email to landlords@lpsni.gov.uk

If you are in doubt or you require further information you can contact LPS Central Landlords Team:

Landlord Article 20 and 21 accounts will normally qualify for 10% discount if payment in full is received by Land & Property Services (LPS) on or before the last banking day in September. If paying by any method, other than Direct Debit single payment, you should allow at least 5 working days for your payment to reach us.

If you are unclear about how to make payment see further guidance on paying business rates.

Landlords may have tenants who receive full or partial assistance with their rates from the Northern Ireland Housing Executive (NIHE). LPS advises that, where the landlord is liable for the payment of rates, they ask NIHE to make any payments directly to themselves rather than the tenant or LPS. This will help to ensure that bill payment deadlines set by LPS are met.

The same level of rates is due on all domestic properties whether occupied or empty. There are some rating exclusions on empty homes that may apply.

All empty domestic properties are charged rates regardless of whether or not they are in the rental sector. There are alternative payment provisions available to landlords depending on the type of rate account that applies to their property. If you require further information you can contact LPS Central Landlords Team:

Different rules apply to non-domestic properties which are empty. Read guidance on Non-Domestic Vacant Rating.

If you have a query regarding your business rates you should contact Land & Property Services.

The Back in Business scheme offers businesses a 50% rates discount for up to two years if they occupy a vacant retail unit.

The Back in Business rate support scheme has been created to incentivise business ratepayers to consider occupying empty retail premises when looking for a business property.

To benefit from the scheme you must meet the following eligibility criteria:

The rates discount of 50% is granted for up to 24 months beginning on the day which the retail unit becomes occupied. The rate relief can be applied from 1 April 2024.

The scheme is now open for applications until Tuesday 31 March 2026.

To apply, you need to complete an online form. If you are the owner or occupier of the applicant business premises, you can complete this at the link below:

Apply for Back in Business rate support

If you have any queries regarding the scheme, you can contact Land & Property Services (LPS) using one of the following methods:

The Small Business Rate Relief (SBRR) provides different levels of rate relief for Northern Ireland business properties depending on their net annual value.

The Small Business Rate Relief (SBRR) scheme is a Northern Ireland government initiative, whose aim is to support the growth and sustainability of small businesses in Northern Ireland, by providing some small business owners with rate relief.

The SBRR provides different levels of rate relief depending on the Net Annual Value (NAV) of the business property. Qualifying businesses will receive the rate relief automatically on their annual bill during the life of the support scheme. There is no need to apply for SBRR.

The SBRR scheme came into effect in April 2010 initially for a term of five years but has since been extended annually on review. The SBRR has been extended for another year covering the 2024-25 rating year.

Eligibility for the SBRR is based on the Net Annual Value (NAV) of your business property.

There are three levels of SBRR:

The following exclusions apply in relation to the SBRR scheme:

For further information on SBRR download the Land & Property Services (LPS) factsheet on Small Business Rate Relief (PDF, 152K).

There is no application procedure for the SBRR. Instead, relief will be applied automatically to your business rates bill by LPS if you qualify. This will ensure that if you are eligible you will receive the benefit of the rate relief immediately.

You can contact LPS through the following methods:

Since 1 April 2012, the SBRR scheme has been modified so that those ratepayers that occupy multiple (more than three) premises of any size, or are part of a chain are not eligible for this rate relief. An example of this would be a chain of bookmakers.

There may be occasions, due to data quality issues, when LPS may not have the relevant information to apply the relief automatically, or they may have awarded it when it is not due. If you think that you should have been awarded the relief, or you believe you have been awarded it in error, you should contact LPS. You can contact your LPS local office by the following methods:

To help fund the extension of SBRR to as many business ratepayers as possible the NI Executive is ending 'double relief'. Double relief refers to business ratepayers who are receiving rate relief twice. Specifically SBRR and one of the following:

The Small Business Rate Relief for small Post Offices is a Northern Ireland government initiative that includes enhanced rate relief for small Post Offices.

The Small Business Rate Relief for small Post Offices is a Northern Ireland government initiative that includes enhanced rate relief for small Post Offices. The aim of the rate relief scheme is to help maintain services in disadvantaged areas, particularly smaller, independent Post Offices.

Eligibility for the Small Business Rate Relief is based on the Net Annual Value (NAV) of your Post Office.

There are three levels of Small Business Rate Relief for Post Offices:

The Small Business Rate Relief for small Post Offices came into effect on 1 April 2010, initially for a term of five years, but has since been extended annually on review.

There is no application procedure for the Small Business Rate Relief for small Post Offices. Instead, relief will be applied automatically to your business rates bill by Land & Property Services (LPS) if your Post Office qualifies. This will ensure that if you are eligible you will receive the benefit of the rate relief immediately.

Download the LPS factsheet on Small Business Rate Relief for Small Post Offices (PDF, 145K).

There may be occasions, due to data quality issues, when LPS may not have the relevant information to apply the rate relief automatically, or they may have awarded it when it is not due. If you think that you should have been awarded the rate relief, or you believe you have been awarded it in error, you should contact LPS. You can contact LPS by using the following methods:

Exemption from business rates if your business has a charitable purpose or public benefit.

Charitable Exemption can apply where a property is occupied by a charity and where the actual use of the premises is dedicated to the charitable objectives of that charity.

Being a charity does not necessarily mean you are entitled to exemption from rates. Both parts of the paragraph above require to be fulfilled before an exemption can apply, this means that LPS will require proof of (a) who is in occupation and (b) what activities are taking place within the premises.

This is a complicated subject and charities should ensure they have sought professional advice in relation to the implications of renting premises. It should not be assumed that exemption will apply simply because the premises are occupied by a charity.

Charitable purposes include formally constituted trusts for:

If you wish to seek Charitable Exemption for a property you must show that it is either a charity, or alternatively that it is not established for profit, and that the use of the premises directly facilitates the charitable objectives.

See below examples where exemption can apply.

A simple example is a church, which is held by trustees whose main objects are the advancement of religion, and the church building is used in connection with these objects.

The use of premises for recreation or other leisure time occupation may also be considered to be charitable if the facilities are provided in the interests of social welfare and are for the public benefit. A village hall or recreation centre often falls into this category.

A charity shop would not have to pay rates if they sell only donated goods. However, if they also sell goods bought wholesale the rateable valuation of the property will be apportioned on the basis of the respective turnover of donated and wholesale goods.

Where the entire property is only used to store items that may be used in connection with the charitable objectives. Storage is not a charitable objective in itself, and therefore exemption cannot apply.

Where a charity has an agreement to make use of premises but has not yet taken up occupation. The period during which a property is being fitted out or is being held pending occupation is not in actual use for the charitable objectives. This timeframe may require rates to be paid until actual occupation and the eligibility criteria are proven to apply.

Where part of a property is occupied by a charity carrying out its charitable objectives and part is used by a person or company running a commercial business those parts identified as being a commercial business will be liable to pay rates. Therefore, either party should advise LPS if such circumstances occur in order to ensure appropriate rating liability is being applied to the correct occupiers.

Where a charity has taken up occupation of a large property but only uses part of the premises, the vacant parts are not being used for the charitable objectives, so those areas cannot fulfil the eligibility criteria. The vacant parts may be apportioned and will attract commercial business rates payable by the occupier - usually the charity.

The application process is in two stages. The first stage is you need to make the application and the second stage is you must fill in a questionnaire.

When applying online select the following option: I wish to apply for a rate exemption or relief; The property or occupier is exempt from rates.