Rates for licensed premises

Business rates and types of premises

Types of property that must pay business rates and those that are excluded.

Business or non-domestic premises include most commercial properties, such as shops, offices, pubs, warehouses, and factories.

Properties excluded from the valuation list for business rates

However, there are some types of properties that are specifically excluded from the valuation list and therefore not subject to rates:

- fish farms

- most farmland and farm buildings

- most cemeteries and crematoriums

- turbary and fishing rights

- moveable moorings

- public parks

- sewers

Properties exempt or partially exempt from business rates

Some other non-domestic premises that are exempt or partially exempt from rates include:

- places of public religious worship and church halls

- district council swimming pools and recreation facilities

- charity shops selling only donated goods

- ATMs in designated rural wards

Mixed-use properties and business rates

If part of a building is used for business and part for residential purposes - such as a shop with a flat above or a solicitor's office in a domestic property - the part used for business counts as non-domestic premises. So, if you live and work on the same premises, you generally pay business rates on the part of the property used for business and domestic rates on the residential part.

Rental properties and business rates

Special rules apply to landlords, owners, and tenants depending on the level of Capital Value for domestic properties or Net Annual Value for non-domestic properties. Rental properties and business rates.

Working from home and business rates

If you use your home as a workplace, the part of the property used for work may be liable for business rates. You will still have to pay domestic rates on the rest of the property. Whether you are charged business rates or not depends on the degree of business use. You are more likely to have to pay business rates if a room is used exclusively for business or has been modified, eg as a workshop. Each case is considered individually.

Queries on your business rates

If you have a query regarding your business rates you should contact Land & Property Services.

Developed withAlso on this siteContent category

Source URL

/content/business-rates-and-types-premises

Links

How business rates are calculated

How rates are calculated for business premises and how to get an idea of what your rate bill may be.

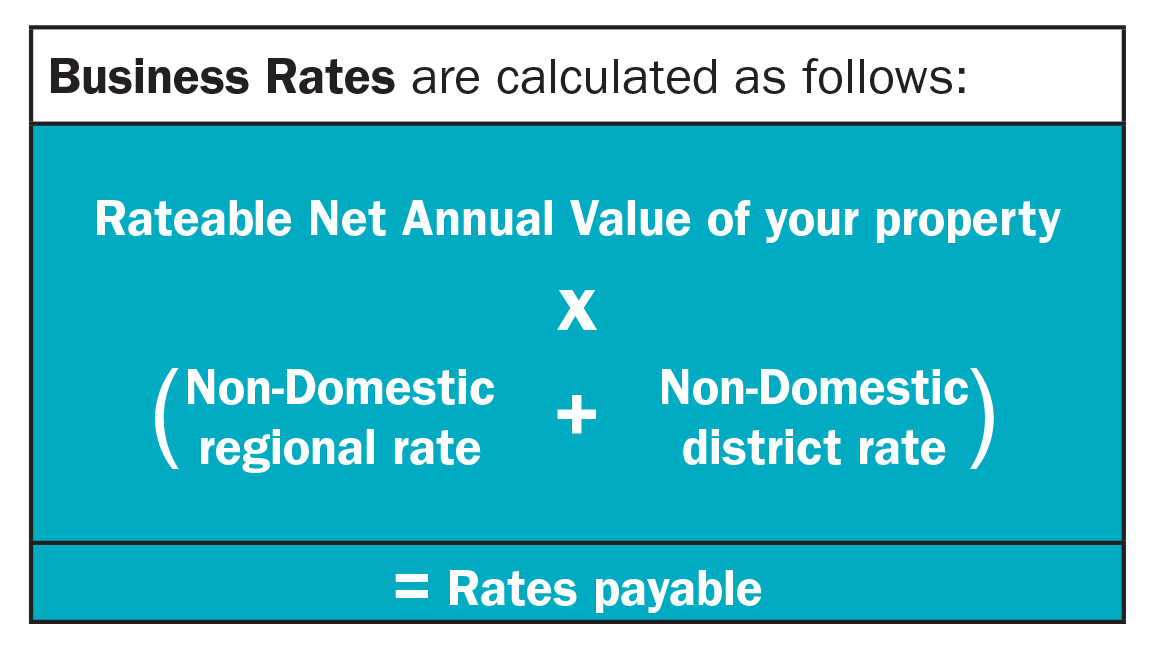

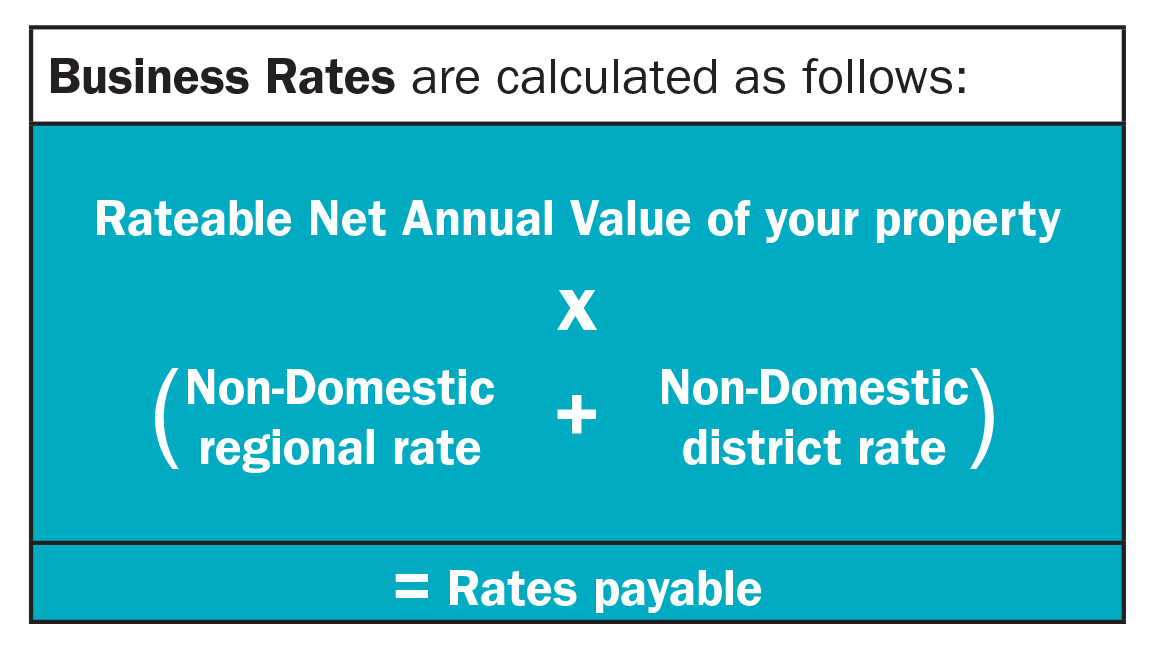

Your rate bill is made up of a number of parts including the regional rate, the district rate and Net Annual Value (NAV). Your rate bill is calculated by multiplying the NAV of your property by the non-domestic rate poundage (non-domestic regional rate + non-domestic district rate) for your council area for the relevant year (as shown below):

Regional and district rates

The regional rate is set annually by the Northern Ireland Executive and is applied to each district council area in Northern Ireland. The district rate is set annually by each district council in Northern Ireland.

Find the the 2024-25 non-domestic rate poundages for your council area.

Net Annual Value

Rates for non-domestic or business properties are assessed on their rental value, also known as the Net Annual Value (NAV). NAV is an assessment of the annual rental value that your property could reasonably be expected to be let for if it was on the open market. Each non-domestic property is valued in line with comparable properties in the vicinity.

The current valuation list for non-domestic properties came into operation on 1 April 2023 and is based on rental values as at 1 October 2021.

Find a property valuation for your business premises.

View your estimated rate bill

You can view an estimate of a full annual rate bill for the current rating year by inputting the address information using the LPS online valuation search.

Find a property valuation and view your estimated rate bill.

Queries on your business rates

If you have a query regarding business rates or are unsure of your outstanding bill you should contact Land & Property Services.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

Developed withAlso on this siteContent category

Source URL

/content/how-business-rates-are-calculated

Links

Rates for retail units

How business rates are calculated for retail units and how this differs from other types of non-domestic properties.

When calculating business rates for retail units Land & Property Services (LPS) assess the Net Annual Value (NAV) by using zoning. Zoning is a methodology used in assessing the rental value of retail units and is used for shops, hair salons, banks, betting shops and most restaurants. LPS use zoning as it helps take into account different sizes and shapes of shops and awkward layouts.

LPS also consider other parts of the property that are ancillary or tertiary spaces such as upstairs offices and store rooms. They are rated but zoning is not applied for these areas of the property. Some spaces are not considered useable retail areas and are excluded from valuation. These spaces include toilets, lobbies, plant rooms and stairwells.

Queries on your business rates

If you have a query regarding business rates you should contact Land & Property Services.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

Developed withAlso on this siteContent category

Source URL

/content/rates-retail-units

Links

Rates for licensed premises

How business rates are calculated for licensed premises and how this differs from other types of non-domestic properties.

When calculating business rates for licensed premises Land & Property Services (LPS) assess the Net Annual Value (NAV) by calculating the correct level of Fair Maintainable Trade (FMT). LPS does this by collecting information about rent, trading receipts, and trading patterns. LPS analyse this information along with the type of premises, the area it is in, and what services it offers.

As there is little evidence of rents for pubs LPS uses FMT in the assessment to help assess a rateable value or NAV. This is the industry standard and is the approach adopted across the UK.

LPS applies a percentage to the estimated FMT to assess the annual rent. It is based on factors such as, where the premises are located, the sort of premises they are (bar, hotel, etc.), and the sort of trade carried on. LPS regularly consults with trade associations to ensure its approach continues to reflect how the licensed industry operates.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

Developed withAlso on this siteContent category

Source URL

/content/rates-licensed-premises

Links

Business rates: occupying and leaving a property

How your business rates are affected if you occupy or leave a property and how to inform Land and Property Services of changes.

Moving into a new business property

When you move into your new property, you must contact your regional Land & Property Services (LPS) Rating office to let them know, otherwise you may receive a backdated rate bill. You can also advise them of how you wish to pay your rate bill.

Moving into a newly built business property

If you are moving into newly built premises you should contact your local LPS Valuation office. A valuer will come out to assess your property. A rate bill will then be issued based on this valuation. You should be aware that failure to inform LPS could lead to the issue of a backdated rate bill.

You can apply online to have your new property valuation assessed or alternatively you can download the LPS application form (CR3) to have your property valued (PDF, 230K).

This is a writable document, which means that you can complete on screen, print and send to LPS. Alternatively, you can save the document to your desktop, complete the form and send as an attachment to your local LPS Valuation office.

Leaving your old business property

When you move out of your property you must contact LPS. You should have your Account ID, Ratepayer ID and details of the new owners or people in your property to hand.

Alternatively you can use the online form to make changes to your rate account such as personal information, billing address for your rate bill, notification of a ratepayer's death or to change the assessment period for your rate account.

Queries on your business rates

If you have a query regarding business rates you should contact Land & Property Services.

Developed withAlso on this siteContent category

Source URL

/content/business-rates-occupying-and-leaving-property

Links

How Land & Property Services uses your information

How LPS uses customer data and how they protect this data under the legislation.

Land & Property Services (LPS) fully complies with the Data Protection Act 2018 and the Department of Finance's Data Protection Policy. This means that how LPS collect, store, use, and disclose/share the information you provide to them meets the standards of this legislation.

Reasons why LPS collates and holds customer information

- For the purpose of billing

- Collection and recovery of rate revenue

- Assessment of benefit/relief claims

- The creation and maintenance of Valuation Lists

- The Land Registration Public Register

LPS and the National Fraud Initiative

LPS has a duty to protect public funds and to this end may use the information provided for the prevention and detection of fraud.

LPS participates in the National Fraud Initiative, an exercise that matches electronic data within and between audited bodies to prevent and detect fraud.

The use of data by the Audit Commission does not require the consent of the individuals concerned under the Data Protection Act 2018. However, it is controlled to ensure compliance with data protection and human rights legislation.

For more information contact LPS or Tel 0300 200 7801.

Developed withAlso on this siteContent category

Source URL

/content/how-land-property-services-uses-your-information

Links

Rates for retail units

Business rates and types of premises

Types of property that must pay business rates and those that are excluded.

Business or non-domestic premises include most commercial properties, such as shops, offices, pubs, warehouses, and factories.

Properties excluded from the valuation list for business rates

However, there are some types of properties that are specifically excluded from the valuation list and therefore not subject to rates:

- fish farms

- most farmland and farm buildings

- most cemeteries and crematoriums

- turbary and fishing rights

- moveable moorings

- public parks

- sewers

Properties exempt or partially exempt from business rates

Some other non-domestic premises that are exempt or partially exempt from rates include:

- places of public religious worship and church halls

- district council swimming pools and recreation facilities

- charity shops selling only donated goods

- ATMs in designated rural wards

Mixed-use properties and business rates

If part of a building is used for business and part for residential purposes - such as a shop with a flat above or a solicitor's office in a domestic property - the part used for business counts as non-domestic premises. So, if you live and work on the same premises, you generally pay business rates on the part of the property used for business and domestic rates on the residential part.

Rental properties and business rates

Special rules apply to landlords, owners, and tenants depending on the level of Capital Value for domestic properties or Net Annual Value for non-domestic properties. Rental properties and business rates.

Working from home and business rates

If you use your home as a workplace, the part of the property used for work may be liable for business rates. You will still have to pay domestic rates on the rest of the property. Whether you are charged business rates or not depends on the degree of business use. You are more likely to have to pay business rates if a room is used exclusively for business or has been modified, eg as a workshop. Each case is considered individually.

Queries on your business rates

If you have a query regarding your business rates you should contact Land & Property Services.

Developed withAlso on this siteContent category

Source URL

/content/business-rates-and-types-premises

Links

How business rates are calculated

How rates are calculated for business premises and how to get an idea of what your rate bill may be.

Your rate bill is made up of a number of parts including the regional rate, the district rate and Net Annual Value (NAV). Your rate bill is calculated by multiplying the NAV of your property by the non-domestic rate poundage (non-domestic regional rate + non-domestic district rate) for your council area for the relevant year (as shown below):

Regional and district rates

The regional rate is set annually by the Northern Ireland Executive and is applied to each district council area in Northern Ireland. The district rate is set annually by each district council in Northern Ireland.

Find the the 2024-25 non-domestic rate poundages for your council area.

Net Annual Value

Rates for non-domestic or business properties are assessed on their rental value, also known as the Net Annual Value (NAV). NAV is an assessment of the annual rental value that your property could reasonably be expected to be let for if it was on the open market. Each non-domestic property is valued in line with comparable properties in the vicinity.

The current valuation list for non-domestic properties came into operation on 1 April 2023 and is based on rental values as at 1 October 2021.

Find a property valuation for your business premises.

View your estimated rate bill

You can view an estimate of a full annual rate bill for the current rating year by inputting the address information using the LPS online valuation search.

Find a property valuation and view your estimated rate bill.

Queries on your business rates

If you have a query regarding business rates or are unsure of your outstanding bill you should contact Land & Property Services.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

Developed withAlso on this siteContent category

Source URL

/content/how-business-rates-are-calculated

Links

Rates for retail units

How business rates are calculated for retail units and how this differs from other types of non-domestic properties.

When calculating business rates for retail units Land & Property Services (LPS) assess the Net Annual Value (NAV) by using zoning. Zoning is a methodology used in assessing the rental value of retail units and is used for shops, hair salons, banks, betting shops and most restaurants. LPS use zoning as it helps take into account different sizes and shapes of shops and awkward layouts.

LPS also consider other parts of the property that are ancillary or tertiary spaces such as upstairs offices and store rooms. They are rated but zoning is not applied for these areas of the property. Some spaces are not considered useable retail areas and are excluded from valuation. These spaces include toilets, lobbies, plant rooms and stairwells.

Queries on your business rates

If you have a query regarding business rates you should contact Land & Property Services.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

Developed withAlso on this siteContent category

Source URL

/content/rates-retail-units

Links

Rates for licensed premises

How business rates are calculated for licensed premises and how this differs from other types of non-domestic properties.

When calculating business rates for licensed premises Land & Property Services (LPS) assess the Net Annual Value (NAV) by calculating the correct level of Fair Maintainable Trade (FMT). LPS does this by collecting information about rent, trading receipts, and trading patterns. LPS analyse this information along with the type of premises, the area it is in, and what services it offers.

As there is little evidence of rents for pubs LPS uses FMT in the assessment to help assess a rateable value or NAV. This is the industry standard and is the approach adopted across the UK.

LPS applies a percentage to the estimated FMT to assess the annual rent. It is based on factors such as, where the premises are located, the sort of premises they are (bar, hotel, etc.), and the sort of trade carried on. LPS regularly consults with trade associations to ensure its approach continues to reflect how the licensed industry operates.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.

Developed withAlso on this siteContent category

Source URL

/content/rates-licensed-premises

Links

Business rates: occupying and leaving a property

How your business rates are affected if you occupy or leave a property and how to inform Land and Property Services of changes.

Moving into a new business property

When you move into your new property, you must contact your regional Land & Property Services (LPS) Rating office to let them know, otherwise you may receive a backdated rate bill. You can also advise them of how you wish to pay your rate bill.

Moving into a newly built business property

If you are moving into newly built premises you should contact your local LPS Valuation office. A valuer will come out to assess your property. A rate bill will then be issued based on this valuation. You should be aware that failure to inform LPS could lead to the issue of a backdated rate bill.

You can apply online to have your new property valuation assessed or alternatively you can download the LPS application form (CR3) to have your property valued (PDF, 230K).

This is a writable document, which means that you can complete on screen, print and send to LPS. Alternatively, you can save the document to your desktop, complete the form and send as an attachment to your local LPS Valuation office.

Leaving your old business property

When you move out of your property you must contact LPS. You should have your Account ID, Ratepayer ID and details of the new owners or people in your property to hand.

Alternatively you can use the online form to make changes to your rate account such as personal information, billing address for your rate bill, notification of a ratepayer's death or to change the assessment period for your rate account.

Queries on your business rates

If you have a query regarding business rates you should contact Land & Property Services.

Developed withAlso on this siteContent category

Source URL

/content/business-rates-occupying-and-leaving-property

Links

How Land & Property Services uses your information

How LPS uses customer data and how they protect this data under the legislation.

Land & Property Services (LPS) fully complies with the Data Protection Act 2018 and the Department of Finance's Data Protection Policy. This means that how LPS collect, store, use, and disclose/share the information you provide to them meets the standards of this legislation.

Reasons why LPS collates and holds customer information

- For the purpose of billing

- Collection and recovery of rate revenue

- Assessment of benefit/relief claims

- The creation and maintenance of Valuation Lists

- The Land Registration Public Register

LPS and the National Fraud Initiative

LPS has a duty to protect public funds and to this end may use the information provided for the prevention and detection of fraud.

LPS participates in the National Fraud Initiative, an exercise that matches electronic data within and between audited bodies to prevent and detect fraud.

The use of data by the Audit Commission does not require the consent of the individuals concerned under the Data Protection Act 2018. However, it is controlled to ensure compliance with data protection and human rights legislation.

For more information contact LPS or Tel 0300 200 7801.

Developed withAlso on this siteContent category

Source URL

/content/how-land-property-services-uses-your-information

Links

Six tips for choosing the right business property

In this guide:

- Choosing business property

- Business property specification

- Choose the right location for your business premises

- Legal considerations when choosing business property

- Deciding on the right premises for your business (video)

- Search for commercial property

- Six tips for choosing the right business property

- Choosing the right premises to suit our business needs - Totalmobile (video)

Business property specification

Preparing a specification that sets out what you want when starting a search for commercial premises.

Drawing up a list of what you need from your business premises is a good way to start your property search. This list is known as a property specification or property spec.

Property specification

Your property spec might list details on how the following requirements should be met when looking for suitable business premises.

Property size and layout

Do you want an open-plan style office space or individual rooms for more privacy? Do you need additional space for equipment, storage, meetings or socialising?

Property appearance

Both internally and externally. For example, do you need a visually attractive property both from the outside as well as the inside especially if clients and/or customers are going to be visiting your business property?

Property structure

Do you require any special structural property requirements such as high ceilings, upper-floor loading or reinforced foundations?

Premises facilities

You should consider the comfort of employees and visitors - including lighting, toilets, reception areas and kitchen facilities.

Property utilities

This can include things such as power and drainage, and any special requirements - for example, three-phase electricity. Take note of the power and heating/cooling requirements that you may need eg power points for computers and heating and air conditioning for staff and customer comfort. An older building may need to be rewired, a new heating or air conditioning system installed or additional toilet and kitchen facilities built. It is also a good idea to identify the broadband capabilities that you will require.

Planning permission

You should take into consideration that you may need to seek planning permission to use the property for your type of business.

Access and parking

Take into consideration access to the property, is it important for it to be near main roads and/or public transport? Is the property accessible for deliveries or customers, including disabled customers? In addition, do you have a requirement for car parking?

Option to extend or make alterations

Consider how flexible the property is so that you are able to make alterations or expand the property if required.

Long-term business plans

Look at your business plan and weigh up how the business property you choose fits into these plans and business direction.

Property location

You also need to think about where you want your property to be located - for detailed location factors you should consider, see choose the right location for your business premises.

Property costs

Your choice of commercial property will also depend on your budget. Whether you rent or buy business premises, costs can include:

- initial purchase costs, including legal costs such as solicitor's fees and professional fees for surveyors

- initial alterations, fitting out and decoration

- any alterations required to meet building, health and safety and fire regulations

- ongoing rent, service and utility charges, including water, electricity and gas

- business rates

- continuing maintenance and repairs

- building and contents insurance

Compare the costs of buying business property with the costs when renting commercial property.

Energy performance of the property

Sellers and landlords are obliged to provide prospective buyers or tenants with an Energy Performance Certificate (EPC). An EPC indicates how energy efficient a building and its services are and can act as a good indicator of likely energy costs. For more information, see Energy Performance Certificates for business properties.

If your property requirements are too specific, you may find that your choice of premises is very limited or you cannot afford them. Think about which requirements are essential and which are desirable, and prioritise them accordingly to make your property decision.

Working from home

After drawing up your list of property requirements, you may decide that working from home could suit you better. However, there are important legal and practical issues you need to take into account - see use your home as a workplace for further guidance.

Also on this siteMore Case StudiesContent category

Source URL

/content/business-property-specification

Links

Choose the right location for your business premises

Identify the advantages and disadvantages when deciding on a suitable location for your commercial property.

A good location for your business is vital, but choosing the right one can be something of a balancing act. Ideally, the location should be convenient for your customers, employees, and suppliers - without being too expensive for your business. You should weigh up the advantages and disadvantages of various locations when deciding on a suitable place for your business property.

Location factors for business property

In order to judge the best location for your business you should consider key location factors and how important each of these are for you and your business priorities. You should consider:

Footfall

Depending on the nature of your business, the amount of passing trade can have a huge impact on the success of your venture especially if your business operates in the retail sector.

Competitors in the area

Although some businesses, like estate agents, can benefit from being located in a cluster of similar businesses, for many others having too many close competitors can have a severe impact on sales and profitability. It is always worthwhile surveying the local area to see if there are potential competitors in the vicinity and considering how this could impact your trade.

Transport links and parking

Good public transport links and local parking facilities make it easier for employees and customers who don't live within walking distance to access your business.

Delivery restrictions

These can cause problems for your suppliers, so you'll need to make sure that your premises are easily accessible if you expect to have regular deliveries.

Planning restrictions

Make sure you check whether you're allowed to use the premises for the commercial purpose you have in mind.

Business rates

These can add greatly to the ongoing costs of locating in a particular area, which may make the premises less desirable from your point of view - see estimate your rate bill to get an idea of what you may have to pay.

Local amenities

Employees generally prefer working in areas with good local facilities, and you may need to make regular trips to the bank or a postal depot.

Type of area

The image of your business may well be affected by the nature of your location and whether crime or anti-social behaviour is .

Making a decision

Whatever option you go for, there are likely to be advantages and disadvantages to the business location that you choose. An office in a rural setting might be relaxing, but could be awkward for staff or suppliers making deliveries to access. Being right in the middle of the city could be very convenient, but might also be expensive in terms of property cost and business rates payable. It may also be costly and inconvenient for car parking within city or town centres.

Location has a major impact on business costs. If you need property in a prime location the extra costs may be justified.

Also on this siteMore Case StudiesContent category

Source URL

/content/choose-right-location-your-business-premises

Links

Legal considerations when choosing business property

Key legal obligations and restrictions to consider when choosing commercial premises.

If you own or occupy a business property, you need to understand the legal obligations and restrictions that may affect you. For example:

- The property must have planning permission that allows it to be used for your type of business.

- You must comply with building, fire, and health and safety regulations. See fire safety and risk assessment.

- Stamp duty is payable on commercial leases and you are likely to be liable for business rates, though in rented premises these may be paid by the landlord.

- You are responsible for the health and safety of employees and visitors. See workplace welfare facilities and healthy working environment.

- You also need to provide a suitable working environment.

- If you provide goods or services to the public, you must take reasonable steps to make your premises accessible. See disabled access and facilities in business premises.

- You need to comply with the terms of any lease or licence agreement. See commercial property: landlord and tenant responsibilities.

- For some businesses, you may require a licence to operate or to sell certain products.

- There may be restrictions on certain periods of time throughout the day or week when deliveries are allowed. There may also be limits on noise and pollution levels that you must meet. You may also have to consider how you or your customers dispose of waste.

- Whatever premises you choose, you need to ensure that you are properly insured. See insurance: business property and assets.

If you are in any doubt about your legal obligations, you should seek professional legal advice from your business adviser or solicitor. Choose a solicitor for your business.

More Case StudiesContent category

Source URL

/content/legal-considerations-when-choosing-business-property

Links

Deciding on the right premises for your business (video)

Short video outlines key factors to consider when deciding on suitable business premises.

Short video (2 minutes 30 seconds) outlines important factors to consider when making decisions about your business premises such as cost, location, facilities and infrastructure.

Also on this siteMore Case StudiesContent categorySelect subtypeVideo

Source URL

/content/deciding-right-premises-your-business-video

Links

Search for commercial property

Specifying what you want when searching for business premises and where you can search for suitable commercial property.

It's worth starting your property search by drawing up a business property specification or 'spec', clearly setting out your business property requirements. This will help distinguish between what is essential and what is desirable in a property for your business. It will also identify the order of priorities when it comes to factors influencing the type and location of the commercial property you desire.

You can then circulate your property specification to estate agents and surveyors that handle commercial properties in your area. They can then let you know if any properties are currently available that match or come close to meeting your requirements.

Searching for commercial property

You can search for business property in Northern Ireland using our commercial property finder.

You may also decide to search for suitable business premises yourself. Commercial property is listed online by estate agents on their own websites or on third-party property listing websites such as PropertyPal, Rightmove, Zoopla, or PrimeLocation, as well as many others.

Check any potential properties against your specification and eliminate any premises that don't at least meet all your essential requirements. Then you can draw up a shortlist of potential business properties to visit.

Professional advice

At this stage, you may want to seek the advice of a surveyor or solicitor. For example, a surveyor can assess the condition of a property and give you an idea of their value. See buying commercial property: using a surveyor.

When you're ready to make an offer or agree the terms of a lease, your solicitor can help negotiate the property deal and complete the legal work. See buying commercial property: using a solicitor.

Also on this siteMore Case StudiesContent category

Source URL

/content/search-commercial-property

Links

Six tips for choosing the right business property

Six tips to help you find a suitable commercial property to buy or rent for your business.

Top tips to help you find suitable commercial premises

1. Draw up a list of what you need from your business premises

How important is property size, layout, location, facilities, structural requirements, and parking to your business needs? Also, think about your long-term business plans and how these might affect your choice of business premises. For example, you might want to expand or alter the property in the future. Order your list by prioritising your desired requirements from the top down. This will help you visualise what the most important factors are for you and your business when deciding on a suitable commercial property. See business property specification.

2. Location, location, location

Choosing the right location for your business premises can be a bit of a balancing act. You may want to choose a location that is convenient for your customers, employees, and suppliers, but isn't too expensive. Some factors you might want to consider when deciding on location include, footfall, where competitors are located, delivery restrictions, parking restrictions, and business rates.

3. Determine whether to buy or rent a business property

You will need to determine whether either buying or renting a commercial property is best for your business needs. You should compare the advantages of renting commercial property with the advantages and disadvantages of buying business property This short video will also help you to weigh up the pros and cons when deciding whether to rent or buy business premises (video).

4. Business rates

Before agreeing to buy or rent a commercial property you will want to get an idea of what you are likely to pay in business rates - estimate your rate bill. You may be eligible for assistance with business rates. See help available for business rates.

5. Legal considerations for commercial property

There are a number of legal considerations when choosing business property including planning permission, health, safety and fire regulations, insurances, accessibility and licences. You will probably need to pay stamp duty if you purchase the property or if you rent a commercial property you will need to comply with the terms of the lease. Ensure you get advice from a solicitor when buying or leasing business premises.

6. Search for commercial property

You can search for commercial property through local commercial property agents, visiting potential areas to see commercial properties for sale or rent, or searching our commercial property finder. Check potential premises against your requirements to create a shortlist of the business properties you might want to view.

Also on this siteMore Case StudiesContent category

Source URL

/content/six-tips-choosing-right-business-property

Links

Choosing business property

Choosing the right premises to suit our business needs - Totalmobile (video)

Video case study explaining how Totalmobile found the right premises to suit the needs of their growing business.

Malcolm Thompson, Chief Operating Officer of software provider Totalmobile, explains how they chose new premises to suit the needs of their growing business.

As Totalmobile expanded and their requirements changed, the business decided to move from its premises in the Antrim Technology Park to new rented premises in Belfast. The business had to consider various factors in order to make the right choice.

Here Malcolm and Chief Executive Colin Reid discuss how the business identified the right premises and overcame the challenges of the move.

Case StudyMalcolm ThompsonContent category

Source URL

/content/choosing-right-premises-suit-our-business-needs-totalmobile-video

Links

Cyber insurance

In this guide:

Commercial property insurance

Types of property insurance available to business owners, including all risk and standard contracts.

If you have business property, taking out a suitable insurance policy will ensure you are covered for damage from a variety of causes. While you should check the policy details carefully, most standard insurance contracts will cover your buildings and premises for a range of risks including:

- fire and lightning

- explosion

- riot

- malicious damage

- storms

- floods

- damage caused by vehicles

Responsibility for insuring business property

If you are a tenant, ask your landlord who is responsible for insuring the premises. Normally the responsibility is with the landlord. The tenant, however, is usually responsible for shop fronts. See commercial property: landlord and tenant responsibilities.

If you are responsible for insuring the property, you could opt for 'all risk' insurance. These insurance policies do not name the risks covered, instead, they list any risks excluded - so all unnamed risks are automatically included. Property insurance policies do not cover:

- wear and tear

- electrical or mechanical breakdown

- any gradual deterioration specified in the policy

You should tell your insurer if your business property is left unoccupied for any length of time. Insurance cover is likely to be reduced to fire only and may not include malicious damage caused by vandalism.

Reinstatement value

You need to insure your business property for the full rebuilding cost, known as reinstatement, rather than just the market value. This is because you will only be able to claim the cost of what you have insured - regardless of the amount of damage.

A chartered surveyor will be able to help you to calculate the reinstatement value.

As well as insuring the building itself, you should also consider taking out public liability insurance if members of the public visit your premises.

Seeking advice on business insurance

To decide on the appropriate level of cover, you should seek professional advice from a regulated insurance company or broker. Insurance brokers, advisers, and other insurance intermediaries are regulated by the Financial Conduct Authority (FCA).

If you choose to deal directly with an insurer, it's worthwhile checking that they are a member of the Association of British Insurers.

HelpAlso on this siteContent category

Source URL

/content/commercial-property-insurance

Links

Business contents insurance

Replacement as new, business interruption and indemnity contents insurance available to business owners.

Property insurance only covers the physical building, so you will also need separate insurance cover for stock, machinery, and contents. You have the choice of either replacement as new insurance or indemnity insurance.

Indemnity insurance

Many business owners choose indemnity cover, which deducts the cost of any wear and tear when settling an insurance claim. Contents are also covered against theft, providing there has been forcible and violent entry to, or exit from, the business premises. See protect your business against crime.

You can also choose a business interruption policy that insures against loss of profit and higher overheads resulting, for example, from damaged machinery.

Seeking advice on business insurance

To decide on the appropriate level of cover it's a good idea to seek professional advice from a regulated insurance company or broker. Insurance brokers, advisers, and other insurance intermediaries are regulated by the Financial Conduct Authority (FCA) and you should make sure that your adviser has FCA authorisation. Find insurance through the British Insurance Brokers' Association.

If you choose to deal directly with an insurer, it's worthwhile checking that they are a member of the Association of British Insurers (ABI).

HelpAlso on this siteContent category

Source URL

/content/business-contents-insurance

Links

Specialist insurance for businesses

Specialist types of commercial assets insurance that might be relevant for your business.

Depending on the type of business you run, it may be wise to take out specialist insurance for your business assets. There are many types of commercial insurance you may wish to consider:

Loss of cash insurance

Provides cover to an agreed limit for the loss of money, whether in transit or from business premises.

Goods in transit insurance

Covers goods against damage while being moved. See insuring goods in transit.

Travel insurance

Essential if you or your employees travel abroad. Ensure that you are covered for working abroad as well as travelling, if necessary. See insure your business - people, life and health.

Commercial legal insurance

Covers legal expenses that may arise out of a change in legislation or penalties resulting from non-compliance.

Credit insurance

Insures you against debtors who are unable to pay you as a result of bankruptcy. See factoring and invoice discounting.

Engineering insurance

Provides specialist cover for machinery, including computers. By law, some types of machinery must be inspected regularly. An insurer will be able to tell you if this applies to your business and will often arrange inspection visits. To insure off-site machinery, you will need to purchase all risks cover.

Glass insurance

Covers the replacement of glass following malicious or accidental damage.

Professional indemnity insurance

Covers you against compensation claims if you have been negligent, resulting in damage or loss to a client.

Data processing insurance

Provides cover for electronic media and electronic data processing equipment.

A fidelity guarantee

Insures against any loss of money or stock as a result of staff dishonesty, such as theft.

Tradesman's tools can often be added to a liability package. See liability insurance.

Find insurance for your business. If you choose to deal directly with an insurer, it's worthwhile checking that they are a member of the Association of British Insurers (ABI).

HelpAlso on this siteContent category

Source URL

/content/specialist-insurance-businesses

Links

Commercial vehicle insurance

Type of motor insurance you will require for business vehicles or if employees use their own vehicle for business purposes.

By law any vehicle used on the road or other public place must be covered by a motor insurance policy. See motor insurance explained.

Vehicle insurance for business

If you, your employees, or anyone else working for your business uses a vehicle for work then you should check that:

- all vehicles owned by your business, such as cars, vans, or lorries, are covered by appropriate insurance

- any employees' vehicles used for or in connection with business have their insurance extended to cover use for their employer's business

- any personal vehicle insurance that you may have also covers business use

You should also make sure that the insurance cover provided by the policy is appropriate as there are different classes of business use. For example, travelling sales people or commercial representatives are considered differently from those making only occasional business trips, or who carry your products or other business assets.

See commercial motor insurance.

Business fleet insurance cover

If you own several vehicles you may be able to get business fleet cover that might offer better terms. Your insurance broker will be able to advise you on this. Find an insurance broker.

You need to check the licences of all your drivers and advise your insurers of any motoring convictions. Otherwise, you will not be properly insured. You will also need to tell insurers of any motoring convictions that happen after any insurance policy is in place. See fleet management.

If you choose to deal directly with an insurer, it's worthwhile checking that they are a member of the Association of British Insurers (ABI).

HelpActionsAlso on this siteContent category

Source URL

/content/commercial-vehicle-insurance

Links

Working from home: business insurance

Specialised insurance for homeworkers is essential as general household insurance will not cover your business.

If you work from home, you may need a specialist insurance policy. Household insurance will not cover any loss of office equipment, nor will it provide public liability cover.

Your standard household insurance may even be invalid if you work from home, although most household insurance policies can be extended to cover this. Similarly, you should check the terms and conditions of your mortgage, as lenders often need to be informed if you use your home to run a business.

Consult your insurance broker about which insurance policy would best suit your business needs and which will evolve with your business as it develops. Find an insurance broker. If you choose to deal directly with an insurer, it's worthwhile checking that they are a member of the Association of British Insurers (ABI).

HelpAlso on this siteContent category

Source URL

/content/working-home-business-insurance

Links

Cyber insurance

Cyber liability insurance helps you recover data losses, damage to IT systems, and costs if your business is the victim of cyber crime.

The vast majority of businesses will rely on IT systems to store and process valuable operational data and customer information. IT systems are vulnerable to cyber security risks such as scams, fraud, information theft, and malware or virus attacks.

A business is responsible for its own cyber security but in the event of a cyber attack, the right insurance policy that covers cyber liabilities may help your business recover. See cyber security for business.

What is cyber insurance?

Cyber insurance or cyber liability insurance is a type of insurance cover that aims to protect your business from IT threats and covers you if your systems or data has been lost, damaged or stolen in the event of a cyber attack.

See cyber risk insurance.

What does cyber insurance cover?

Most cyber insurance policies generally cover first-party and third-party costs relating to a cyber-attack.

First-party cyber insurance

First-party cyber insurance covers damage to your business such as the cost of investigating the cyber crime, restoring IT systems, recovering lost data, reputational damage, extortion payments demanded by cyber criminals and costs relating to business shutdown.

Third-party cyber insurance

Third-party cyber insurance covers the assets of others, typically your customers and any potential claims against you including damages and settlements as well as legal costs to defend your business.

Does my business need cyber insurance?

If your business uses, sends, or stores electronic data you could be vulnerable to cyber crime. Cyber insurance could help you with financial and reputational costs if your business is ever the victim of a cyber attack.

Also on this siteContent category

Source URL

/content/cyber-insurance

Links

Get the right insurance cover for your business

How to choose an appropriate insurance policy for your business, minimise costs and use insurance brokers.

There are many different types of insurance cover your business may require depending on what it does, how it operates, and where it does business. Each type of business insurance is designed to cover a different set of risks that you face in the course of running your business including:

- liability insurance

- commercial property insurance

- business contents insurance

- commercial vehicle insurance

- cyber insurance

- working from home: business insurance

- specialist insurance for businesses

See also business insurance: the basics.

Using an insurance broker

Few business owners deal directly with insurers. Most prefer to go through an insurance broker for impartial insurance advice. Insurance brokers can advise you on whether a single insurance policy or a combination of single insurance policies would be more appropriate. Be sure to give all relevant information to the insurer, otherwise, an insurance policy may not be valid.

Insurance brokers, advisers and other insurance intermediaries are regulated by the Financial Conduct Authority (FCA) and you should make sure that your adviser has FCA authorisation. Read the FCA guide to SME insurance brokers.

If you buy products or services from insurance intermediaries, you have the right to ask the intermediary how much commission they get for selling the product or service to you.

Dealing directly with an insurer

If you do choose to deal directly with an insurer, it's worthwhile checking that they are a member of the Association of British Insurers (ABI).

Some key points to consider when buying insurance are:

- quotes - get quotes from several different insurers or ask your broker to do so

- comparisons - compare the levels of cover in various insurance policies to make sure you get the right level of cover that your business requires

- tailored insurance - talk to your broker about whether you need an insurance policy tailored to your specific needs

What to consider when buying insurance

Other factors to take into account when choosing an insurance policy are:

- what the insurance policy will cover

- service

- cost

- whether there is a no-claims bonus

- whether the insurer offers 24-hour legal advice and emergency helplines

- the level of excess - the amount of each claim that you will have to pay yourself

- the extent of excess to be retained by your business

HelpAlso on this siteContent category

Source URL

/content/get-right-insurance-cover-your-business

Links

Making an insurance claim

Prompt contact with your insurer makes the process of making a claim for damage or loss of assets easier.

As soon as you discover a loss or damage to your business assets, you need to report it to your insurance provider. If you think that the loss or damage is due to a criminal act, you should report it to the police immediately. You should write down as many details as possible about what happened and when.

Information you need to provide to insurers

You will also need to provide your insurers with:

- estimates for repairs

- proof of the cost of any emergency repairs that were required, eg to make equipment or premises secure

- proof of ownership

- the cost of the items you are claiming for, with valuations and/or receipts

- a police crime reference number, if you think that your business has been the victim of a crime

- the opportunity to inspect any damaged assets if required

If you need to make emergency repairs, do so and advise your insurers of what you have done. If possible, advise insurers before going ahead, but it is most important that you prevent further damage that might increase the claim.

Loss adjuster

For large or complicated claims, the insurance company will often employ a loss adjuster. They will inspect the damage and check insurance claims for quantity, description, and pricing. Loss adjusters are impartial experts who can advise both the insurer and the policyholder.

They can also advise you on:

- how to improve security and safety

- areas of cover you may have overlooked

- repair techniques and specialist companies that can carry out such work

Loss assessor

You could employ a loss assessor who will negotiate and settle the insurance claim on your behalf. However, since they will charge a fee, it is usually only worth considering if you are likely to make a substantial insurance claim.

HelpAlso on this siteContent category

Source URL

/content/making-insurance-claim

Links

Secure your business premises

In this guide:

- Protect your business against crime

- Business security survey

- Secure your business premises

- Business security: protecting staff

- Secure your business assets

- Business security: cash

- Business security: stock and theft prevention

- Reporting a crime against your business

- Preventing identity theft, scams and fraud

- Business security plans and procedures

- CCTV surveillance

Business security survey

How to protect your business internally and externally by performing a survey to reveal weaknesses in security.

To protect your business premises, you should first assess the local environment, eg street, business park or shopping centre. You can look at the level and types of crimes that are being carried out in your area using the Police Service of Northern Ireland's (PSNI's) official crime statistics.

Business security survey

This assessment will form part of your first steps to performing a full security survey. A business security survey should include both an external and an internal assessment of any crime risks to your business. Try the onion-peeling principle, which involves thinking about your business and its premises as a series of layers, to conduct your survey.

Preparation for security survey

When using the onion-peeling principle, you should take security measures at each layer to delay and deter the criminal and to protect or remove any potential targets for crime. There are three types of physical targets in most businesses:

- buildings - eg stores and garages

- property - eg cash, stock and equipment

- people - ie staff, security guards and visitors

Your aim at each layer is to:

- reduce the potential rewards of crime

- reduce any potential provocation to commit crime

- remove any potential excuses for criminal behaviour

You should concentrate on all areas of security and consider all potential targets and the effects on them, such as financial loss, temporary closure, inability to deliver goods, or staff morale. Other risks to consider include: fraud, violence, graffiti, computer data theft, etc.

When preparing your security survey, you should take into account:

- the amount and types of crime in the area

- whether anyone nearby has been a victim of crime

- whether any business crime partnerships exist in the area

Use a map to identify access to your business property and potential entry and escape routes. You need to consider any escape routes for offenders that may not be easily seen.

Carrying out a security survey

Consider using a security checklist when undertaking a safety survey to ensure that you cover all areas of concern.

You should keep notes on your security survey to help future security plans and make them more effective.

There are four areas to consider for your security survey:

Environment

The area around your business - eg the street or alleys bordering your premises.

Perimeter

How someone could gain access to your business property from the public space.

Outer shell

For example, doors and windows that could provide access to your buildings.

Interior

Consider inside the building, and how this could be protected from criminal activities.

You should walk around the boundary of your business property and check for any weak areas, both during the day and when dark. Identify opportunities for crime, such as:

- walls or fences that could be climbed

- bins or other objects that could be used to climb or could be targeted for arson

- tools or materials left out that could be used to break in

- possible hiding places

- any poorly lit areas that could be used as cover for a break-in

Fencing and property boundaries

Steel fencing, railings or walls of at least 2.5 metres in height can make effective boundaries for your business property. You could also use barbed or razor wire, rotating vanes or electric fence alarms at the top of fences or walls, and anti-climb paint to make access harder.

When dealing with the shell, you should think about security measures that will delay an attempted break-in or put off potential offenders.

You should pay particular attention to the:

- roof, especially a flat roof

- cellar

- loading bay

- side of your business

- back of your business

You should think about how a criminal might view the business when open and closed, during the day or at night.

ActionsAlso on this siteContent category

Source URL

/content/business-security-survey

Links

Secure your business premises

Secure your business property by applying the right security measures to deter criminals.

In order to protect your business property from crime, first carry out a business premises security survey. Once you have determined the main security risks to your business, you can decide what actions you should take.

Which security measures should I take?

The basic idea is to introduce measures that will delay and deter potential offenders from seeing your business as an easy target for crime. We have outlined below security measures that you could apply to protect your business:

Secure access points

Have strengthened doors fitted, ensure all windows have locks, install strengthened shutters, and ram raid barriers if necessary.

Secure the perimeter

Ensure gates are secure and fences aren't damaged or provide opportunities for access. Applying anti-climb measures can also be effective, however, you must have signs to state you have them installed.

Access control

Control access to the business by keeping a record of who has keys or passes and ensure employees that leave hand them back.

Lighting

Install security lights at dark points that will come on when movement is detected.

Alarms

Fit intruder alarms.

Secure property

Secure equipment with asset tags and record details of serial numbers. You should also consider securing devices such as laptops and tablets to larger equipment such as desks. Secure your business assets.

Stock control

Protect stock by keeping regular tabs on stock levels.

IT security

Address IT security issues such as hard-drive encryption, off-site data storage, and software security updates. Protect your business online.

Sensitive information

Carefully dispose of any sensitive documents or information by shredding sensitive paper waste.

Security cameras

Install CCTV surveillance and regularly check that your cameras are in full working order.

Any measures that you take should be legal, appropriate, realistic and cost-effective.

For further guidance on securing your business property see the National Security Inspectorate's workplace security safety guidance.

Professional security consultants can offer a comprehensive risk assessment of any premises and can recommend security measures to meet the risks faced.

ActionsAlso on this siteContent category

Source URL

/content/secure-your-business-premises

Links

Business security: protecting staff

How to provide a safe workplace and develop strategies that will protect employees from criminal and violent behaviour.

As an employer you have a employers' health and safety responsibilities. Bringing in measures to improve staff safety and making employees and customers aware of their responsibilities can also improve the security of your business.

Improve staff security

Steps you can take might include:

- checking visitor and delivery personnel identities

- always checking the identity of people you deliver to

- getting signatures for the receipt and issue of goods

- CCTV system to cover entrances and exits

High security risk businesses

If your business handles a lot of cash or expensive goods, it makes sense to use a properly fitted protective screen to protect staff (eg at a cash register), closed-circuit television (CCTV), and secure storage such as a safe. See business security: cash.

If your business is at risk or is in a high-risk area, it might also be appropriate and cost-effective to employ security guards.

You could also join local community initiatives or Neighbourhood Watch initiatives. Contact the PSNI for details of initiatives in your area.

Customers and business security

All customers should be asked to remove motorcycle helmets and scarves that cover a face before they enter your business premises. A height mark at the door can be used by staff to accurately gauge the height of a criminal if a report of crime needs to be made to the police. If the height mark is highly visible this can also act as a deterrent for potential criminals that target your shop.

Employees who work alone

If you employ staff who work alone, you can help to reduce risks to them by using:

- personal alarms

- radio link scheme

- controlled access or CCTV with audio

- automatic warning devices

- lone-worker monitoring devices

- regular police or security checks

You could also ask staff to vary their routes and times for added security. Ensure lone workers' safety.

When a violent incident happens

Violent incidents can involve theft, angry customers, or customers under the influence of alcohol or drugs. You can offer staff training in conflict management to deal with aggressive customers. Advise staff not to put themselves at risk, and to move away from aggressive customers but avoid becoming isolated.

When necessary they should dial 999 or get help quickly by using an alarm. They should try to write down information about what happened and secure CCTV footage and the scene until the police arrive.

All such incidents should be reported to the police. This can be done by dialling 999 in an emergency, or 101 for non-emergency situations.

Victim support

If a member of staff is a victim of violence, they may need medical attention, which may be available in-house or may be required from the ambulance service. However, they will need your support. This might include:

- a debriefing - talking about what happened

- giving time off to recover

- suggesting specialist counselling

Other staff who witnessed the incident may also be affected. They can get help and support from Victim Support NI.

Download violence at work guide (PDF, 105K).

Bomb threats and suspect packages

You should ensure staff know what to do in the unlikely event of a bomb threat or a suspect package is found on your business premises. Download the PSNI's business guidance on dealing with bomb threat telephone calls and suspect packages (PDF, 212K).

Tiger kidnap

Tiger kidnap involves the short-term hostage-taking of family members of an employee who has immediate access to cash or valuables. The captives are frequently held overnight and the aim of the criminals is to frighten their victims to such a degree that they will not contact the police, even when they have an opportunity to do so.

Also on this siteContent category

Source URL

/content/business-security-protecting-staff

Links

Secure your business assets

How to identify and protect your assets, including your vehicles and transported goods.

There are a few simple procedures to follow that will help to protect your assets on and off-site. Assets or property could include:

- computer equipment, laptops, or tablets

- mobile phones

- information stored on computers, organisers, or on paper

- business vehicles

- specialist equipment and tools

- plant and machinery

Marking business assets

You should permanently mark each piece of equipment and make a note of the:

- make

- model

- serial number

You should also maintain a record of all business assets, where they are located, and who is responsible for them. Asset checks, as well as stock checks, should be carried out by a dedicated member of staff.

Secure essential and high-value equipment in a separate secure room.

Computer equipment and mobile phones

If a computer, laptop, or tablet is lost or stolen, often the loss of information and data can be more of a serious issue than the cost of a replacement. This will particularly be the case if personal information is held on the computer. It could damage your reputation, affect your business's ability to operate, put individuals at risk, and result in a substantial fine. Read PSNI guidance on what you can do to protect computers in your business.

A way to address this issue would be to use cloud computing. This lets you store business information and use hardware and software remotely and securely over the internet.

Protecting business data

You should carry out an assessment of the risks and take measures to keep your physical and information assets safe. Common threats include:

- cyber crime - malicious people might gain access to your systems and alter, steal or delete data - cyber security risk management

- viruses - programs that are created to cause a nuisance or damage computer systems - detect spam, malware, and virus attacks

- fraud - theft of sensitive data such as employee records or valuable intellectual property by hackers or even your own employees - business data breach and theft

- data loss - caused by any of the above or by loss of hardware - eg by a flood at your premises

Small steps can help increase data security. For example, all computers should be password protected and have an internet firewall and anti-virus software. Employees who use computer equipment on a regular basis should change their passwords and back up their files regularly. Any information kept on electronic equipment should be copied and kept securely off-site and in a fire-proof safe. Protect your business online.

Every individual mobile phone can be identified by a unique International Mobile Equipment Number (IMEI). The IMEI can be found by typing *#06# into the handset and should be written down and stored securely.

Protecting business vehicles and transported goods

Any vehicles you own should be treated in the same manner as the shell of your business. You should always secure the doors and windows and have a lockable box in the cargo area. You can also add extra security, such as:

- an alarm

- a vehicle tracking system

- an immobiliser

- a steering lock

For high-value vehicles and machinery, such as tractors or plant machinery, you could consider marking property or fitting a tracking device. Read PSNI guidance to help prevent plant machinery thefts.

Reflective film on the windows will help to hide the interior. You should always make sure that anything left inside is hidden from view and use signs to let people know that nothing of value is left inside. If your business receives a lot of cash over the counter, it should be removed frequently to a secure location.

Secure lorry parks should be used for overnight stops.

For goods delivered by post, it might be appropriate to use a more secure service such as recorded or special delivery.

Building site security

Building sites are often the target of crime with a lot of high-value plant, machinery, and tools on site along with large quantities of materials such as cement, bricks, concrete blocks, steel, and timber. See the National Business Crime Centre's guidance on construction site security.

Also on this siteContent category

Source URL

/content/secure-your-business-assets

Links

Business security: cash

How to handle cash, cheques, and debit and credit card payments securely.

If you or your employees handle cash, try to avoid getting into a routine when depositing it to a bank or building society. It is also wise to reduce the amount of cash held on your business premises where possible. This can be done by:

- making a regular, secure payment into the bank

- transferring excess cash into a locked tamper-proof unit

- removing cash overnight - eg emptying tills

- encouraging the use of electronic payments, credit/debit cards or cheques

- paying wages straight into staff bank accounts

Keeping cash on site

If cash has to be kept on-site, you should make sure it is held in a secure manner - eg a safe that is fitted to the building. Where possible the minimum amount of cash should be held in public areas and tills should be cleared regularly. Drop-safes, with time-locking mechanisms, should be used to ensure that cash is held securely.

Staff should not handle cash alone and anyone who deals with financial records should not handle cash.

Moving cash around

When you or an employee makes a secure payment to the bank, it should not be made alone. It is also advisable to vary the times and the route used. Restrict information about cash movement to those directly involved and consider using a professional cash-in-transit business.

Stained and counterfeit cash

Encourage your staff to be aware of the risk of accepting stained notes as these could have been stolen. Notes become stained when a cash degradation system has been set off during a robbery. These systems are used in tills (by banks, post offices, building societies, and retail outlets), cash points, and cash boxes used by cash-in-transit companies that deliver and collect cash.

If you are offered a stained note by a member of the public, treat it as you would a mutilated or damaged note and do not accept it. Advise the customer to take the note to a Post Office or bank and obtain a Bank of England Mutilated Note (BMN) claim form for the repayment of damaged notes see further information on damaged and contaminated banknotes. By filling in this form and going through the proper channels, providing the note is genuine, they will be reimbursed for the note they have handed in.

There are a number of ways to tell if a note is counterfeit or genuine. It is illegal to keep or pass on fake notes. Stopping criminals from spending stained or counterfeit notes helps to remove the incentive for crime.

Cheques

The number of cheques being used has declined in preference to the use of online banking and electronic payment systems. These systems have the benefit of additional security and anti-fraud measures. In spite of this cheque, fraud has become more organised and sophisticated with advances in computer and printing technology.

Writing cheques

When writing cheques:

- always fill out cheques with the full details of the payee

- avoid any blank spaces and rule out any unused space

- when sending by post, it is best to send securely and not use a windowed envelope

- store cheques securely and use them in serial number order

- be sure to compare cheques written with the correct paperwork

- destroy spoiled cheques by shredding if possible

Accepting cheques as payment

When accepting cheques:

- ensure they are written, signed, and torn out in front of you

- check that date and amount are correct

- don't release goods before bank drafts are cleared

- if you receive a cheque for far too much and are asked to send the balance back to the drawer by electronic funds transfer, this is probably a scam where the cheque will bounce but your account is still debited

Debit or credit cards

You must have procedures in place for handling credit and debit cards. The secure chip and pin system should be used where possible. If you are unable to use chip and pin, you should check the cards for:

- start and expiry dates

- signs of tampering

- matching number on the card and till printout

- matching signature

If in doubt, you can always phone the card issuer for authorisation.

Contactless payment has become a more popular method of paying through cards as well as wearable and mobile devices.

Also on this siteContent category

Source URL

/content/business-security-cash

Links

Business security: stock and theft prevention

Keep track of stock, maintain security, and avoid staff theft by restricting access to stock and using CCTV.

Keeping stock secure depends on knowing what you have and where it is located, so you should keep records of when stock is sold, used, replaced, or thrown away. In order to keep stock secure, you should:

- keep records of stock with regular stock checks - including deliveries

- stock control system - ensure a system of reporting stock variations is in place and amendments to the records only take place after authorisation, see stock control systems - keeping track using computer software

- keep stock away from doors and in a place where it takes an obvious action to reach

- use secure lockable, fireproof cabinets or rooms for high-value stock

- use mirrors or closed-circuit television (CCTV) to keep stock and equipment monitored

- try to limit the number of people who have access to valuable stock

Thieves and shoplifters

Staff should always be vigilant for any suspicious behaviour and should take appropriate action, such as reporting an incident. Suspicious behaviour could include:

- choosing purchases quickly

- trying to rush the transaction

- working in groups to distract your staff

- splitting purchases between different debit or credit cards

To find out what else you can do to deter this type of crime, see top tips to reduce shoplifting.

Prevent theft by staff

There are a number of measures you can take to combat theft by staff, for example:

- create an honest work culture - educate your staff about the potential costs of theft and have a clear, communicated policy on this issue

- restrict access to warehouses, stockrooms, and stationery cupboards

- install CCTV in staff car parks

- regularly change staff who control stock to avoid collusion or bad practice

Staff credentials

Before you employ a new staff member, you should check the identity of the staff member and their references thoroughly.

You are also required to check that potential employees have the right to work in the UK. See pre-employment checks.

Also on this siteContent category

Source URL

/content/business-security-stock-and-theft-prevention

Links

Reporting a crime against your business

How to report a crime against your business to the PSNI or Crimestoppers.

If you need to report a crime against your business in an emergency dial 999.

Non-emergencies

For non-emergency incidents and general enquiries, dial 101 - the Police Service of Northern Ireland's (PSNI) non-emergency number. A trained member of staff will take your call. Contact the PSNI.

When you ring the police to report a crime, the police will give you a Crime Index number. Keep this number for future reference, as you might need it when discussing the incident or accessing police records.

Anonymously report a crime

You can also report crime anonymously by calling Crimestoppers, an independent charity helping law enforcement locate criminals and help solve crimes. You can call Crimestoppers on Tel 0800 555 111.

Also on this siteContent category

Source URL

/content/reporting-crime-against-your-business

Links

Preventing identity theft, scams and fraud

How to protect your business from the risk of identity theft.

Identity theft and fraud can be a threat to your business, particularly if you carry out any part of your business online.